Advertisement|Remove ads.

Webull Q3 Earnings Preview: Crypto Trading Volumes In Focus After Relaunch

- During the second quarter, the company, founded by Alibaba and Xiaomi veteran Wang Anquan, reported a 46% year-over-year increase in revenue to $131.5 million.

- Investors will be keenly waiting for the results of its crypto-trading segment, after it relaunched the services earlier this year.

- Larger peers Coinbase and Robinhood have reported a surge in quarterly revenue, aided by robust trading activity.

Webull stock dipped over 14% over the past week, amid broader weakness in cryptocurrency markets, ahead of its third-quarter earnings due later on Thursday.

According to Fiscal.ai data, Wall Street expects the company to report earnings of $0.03 per share, on revenue of $137.5 million, for the quarter ended Sept. 30.

What Are Stocktwits Users Thinking?

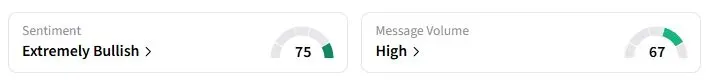

Retail sentiment on Stocktwits about Webull was in the ‘extremely bullish’ territory at the time of writing, while retail chatter was ‘high.’

One Stocktwits user said that $12.5 is a reasonable move for the stock following earnings.

“This market is so volatile, I wouldn’t be surprised if we see 12-15 this week with good earnings,” another trader said.

Investors will be keenly waiting for the results of its crypto-trading segment, after it relaunched the services earlier this year. Larger peers Coinbase and Robinhood have reported a surge in quarterly revenue, aided by robust trading activity.

Wall Street is also looking forward to commentary on new tools, such as their AI-driven decision-making platform, “Vega.”

Webull’s Q2 Revenue Showed Robust Growth

During the second quarter, the company, founded by Alibaba and Xiaomi veteran Wang Anquan, reported a 46% year-over-year increase in revenue to $131.5 million. Webull has more than 24 million registered users globally and entered the European market in September with the launch of brokerage services in the Netherlands.

Rosenblatt Securities analysts praised Webull in late September, noting that while it began as a specialized data platform, the company has transformed into the second-largest mobile-first brokerage in the U.S. It now offers a top-rated app and a comprehensive desktop service designed for active retail traders. The brokerage also expected the company to sustain annual revenue growth of more than 25% through 2027, well above forecasts.

With shares down nearly 30% this year since its SPAC merger in April, Webull’s guidance and crypto-volume commentary may determine whether retail optimism proves justified."

Also See: Bitcoin Holds Above $92K As Markets Brace For Jobs Data; Bitwise Confirms XRP ETF Debut

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202237165_jpg_188d67bdb5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_2_jpg_0c6789db95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263736058_jpg_2b8f901978.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244298120_jpg_ceb8c90666.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_iran_jpg_753ef9f5af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)