Advertisement|Remove ads.

Tesla Price Target Hiked To $500 By Wedbush Securities: But Retail’s Undecided

Wedbush Securities on Friday hiked its price target on Tesla Inc. (TSLA) to $500 from $350 while keeping an ‘Outperform’ rating on the shares.

The new price target implies a near 47% upside to the stock’s closing price of $341.04 on Thursday.

The brokerage said in a note that Tesla's “dark chapter” since the start of this year is “in the rear-view mirror,” with Elon Musk pulling back on his role as head of the Department of Government Efficiency (DOGE) in the Trump administration and recommitting to leading Tesla as CEO.

While the analyst noted concerns around Model Y growth in China and Europe, he said the core focus for investors is artificial intelligence (AI).

“The vast majority of valuation upside looking ahead for Tesla is centered around the success of its autonomous vision taking hold with a key June launch in Austin…,” the analyst added.

Earlier this week, Musk said Tesla will launch its robotaxi service in Austin late next month. The Tesla CEO pointed out that the pilot program will start with around 10 vehicles in some parts of the city and could quickly scale into the thousands if early tests go smoothly.

Wedbush estimates that Tesla's AI and autonomous driving opportunity is worth at least $1 trillion and, in a bull case scenario, expects the company to reach a $2 trillion market cap by the end of 2026.

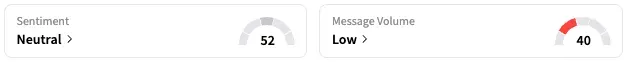

On Stocktwits, retail sentiment around Tesla fell from ‘bullish’ to ‘neutral’ territory over the past 24 hours while message volume remained at ‘low’ levels.

According to data from Koyfin, 23 of 48 analysts covering Tesla have a ‘Buy’ or higher rating, while 11 rate it a ‘Sell’ or ‘Strong Sell,’ and 14 rate it ‘Hold.’

The average price target for the stock is $295.81, implying a downside of about 13%.

TSLA stock was up about 1% in pre-market trading on Friday. Although the stock has been down about 10% this year, it has nearly doubled in value over the past 12 months.

Also See: Oil Poised For Weekly Decline As OPEC+ Oversupply Concerns Linger

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)