Advertisement|Remove ads.

Retail Gets Bullish On Chinese Microblogging Company Weibo After Q4 Beat But Stock Slips

Weibo Corp. (WB) stock took a hit on Thursday despite the Chinese microblogging social media company reporting a quarterly beat but retail turned bullish.

The Beijing-based company reported non-GAAP earnings per share (EPS) of $0.40 for the fourth quarter of the fiscal year 2024. This marks an increase from the $0.31 per share earned a year ago.

The quarterly EPS exceeded the Finchat-compiled consensus of $0.39.

Net revenue fell 1% year over year (YoY) to $456.8 million compared to the $451.76-million consensus estimate. Weibo noted that advertising and marketing revenue declined 4% to $385.9 million, while value-added services climbed 18% to $71 million.

Among operational metrics, monthly active users (MAU) stood at 590 million at the end of December, and average daily active users (DAU) at 260 million, up from 587 million and 257 million, respectively, at the end of September.

Gaofei Wang, CEO of Weibo, said, “We capped off the year with solid performance in the fourth quarter of 2024.”

The executive said the company is proactively focused on the acquisition and engagement of high-quality users and has optimized its content ecosystem by emphasizing its core strength areas, investing in vertical content, and constructing an artificial intelligence (AI)- powered content ecosystem.

The company also said its board approved adopting an annual dividend policy and paying a $200 million annual dividend for 2024.

Following the quarterly results, investment bank Jefferies maintained a ‘Buy’ rating on Weibo stock and upped the price target to $12.10 from $10.90, TheFly reported.

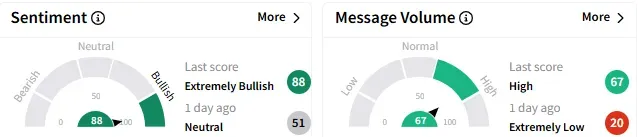

On Stocktwits, retail sentiment toward Weibo stock improved to ‘extremely bullish’ (88/100) from the ‘neutral’ mood that prevailed a day ago. The message volume climbed to ‘high’ levels.

Weibo stock fell 2.60% to $10.48 Thursday afternoon after rising nearly 13% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: IonQ Stock Slides After Kerrisdale’s Short Report Slams ‘Absurd’ Revenue Multiple: Retail’s Unswayed

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2216479170_jpg_edce233c83.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)