Advertisement|Remove ads.

Opendoor Stock Pops After-Hours On Trump’s Plan To Drive Mortgage Rates Down, Retail Bulls Pile Back In

- President Donald Trump said he plans to instruct the government to buy $200 billion in mortgage bonds, which will lower mortgage rates and make homes more affordable.

- His comments come a day after he announced plans to ban institutional ownership of single-family rental units, leading to volatility in the housing-related stocks

- Opendoor’s sharp rally has brought cheer for its investor after the meme stock had dulled in the latter part of last year.

Opendoor Technologies, Inc. shares jumped more than 12% in extended trading after U.S. President Donald Trump said on Thursday he was directing the federal government to purchase $200 billion in mortgage bonds, a move he said would help bring down mortgage rates as Americans grapple with elevated home prices.

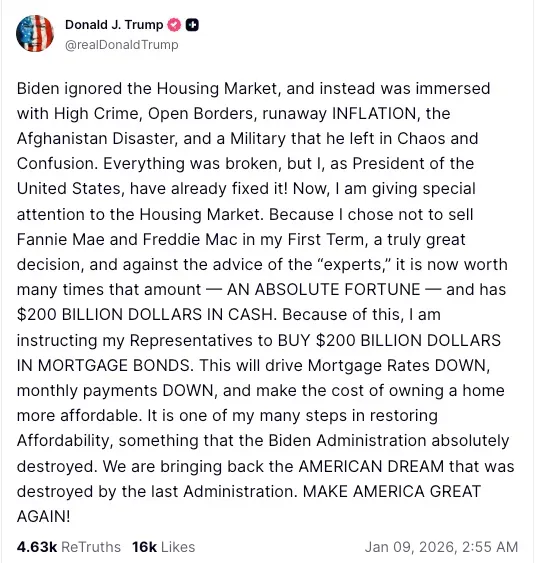

Trump Wants To Make Housing Affordable

“I am instructing my representatives to buy $200 billion in mortgage bonds. This will drive mortgage rates down, monthly payments down, and make the cost of owning a home more affordable,” Trump said in a Truth Social post.

“It is one of my many steps in restoring affordability,” he said, adding that he’s giving “special attention” to the housing market. Trump’s comments come a day after he floated a plan to bar large institutional investors from buying single-family homes and argued that corporate ownership had pushed housing prices higher and often out of the reach of many Americans.

Volatility In Housing Stocks

The series of news pertaining to the housing market has had sectoral investors scrambling. Trump’s Thursday comments prompted a rebound in shares of home builders D.R. Horton, Lennar Corp., and PulteGroup, as well as those of investment firms with heavy real estate portfolios, such as Blackstone and Apollo Global Management.

For Opendoor, a widely watched meme stock, the development brought much-needed cheer from the retail investor community after the stock had dulled in the latter part of last year.

On Stocktwits, retail sentiment for OPEN climbed higher in the ‘extremely bullish’ zone (94/100) as of late Thursday, with the ticker featuring at the top of the trending list on the platform. So far this year, Opendoor shares have gained over 10%.

Meanwhile, an Opendoor executive clarified that Trump’s ban on institutional ownership of single-family rental homes would not affect the company. “The policy targets landlords owning 100+ homes, but not owner occupants or consumer platforms… Opendoor is not an institutional landlord. We don’t build SFR portfolios,” the company’s head of homebuilder partnerships, Kia Nejatian, said in an X thread.

Housing Market Impact

He, however, added that a broader ban that includes BTR (build-to-rent) could actually reduce housing supply, since BTR now accounts for a meaningful share of new single-family construction growth. Constrained supply would lead to higher prices, he said.

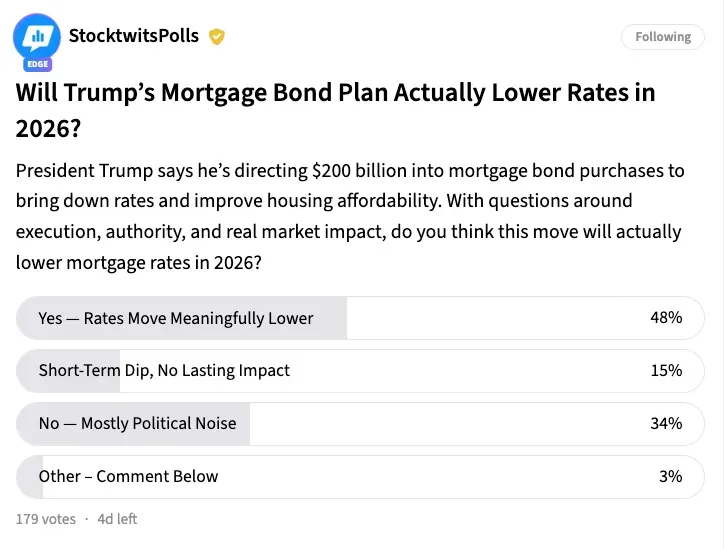

Meanwhile, early results of a Stocktwits poll showed that retail investors expect mortgage rates to decline meaningfully and housing affordability to improve.

The U.S. faces a housing crisis as high prices and macro uncertainty make buying a home increasingly difficult for most people. The market is expected to stay weak through 2026 due to elevated mortgage rates, with only a modest rebound seen in 2027, according to a Reuters survey of property experts.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)