Advertisement|Remove ads.

WeightWatchers Seeks Chapter 11 Bankruptcy Protection As GLP-1 Obesity Drugs Reshape Industry

WW International (WW), popularly known as WeightWatchers, filed for Chapter 11 bankruptcy protection on Tuesday after its business struggled for years due to the rise of weight loss drugs.

The company's shares dipped over 56% in extended trading after ending up 11.2% in the regular session.

Media reports about the potential bankruptcy have been swirling for a few months, leading to a whipsawing in the company's stock, which has traded below $1 for the better part of the year; however, signals have been mixed in recent weeks.

WW recently announced a tie-up to sell Eli Lilly's (LLY) popular weight loss drug, Zepbound, through its platform. Earlier, Galloway Capital Partners disclosed a 2.87% stake in the company and urged it not to consider bankruptcy.

WW said the reorganization plan would eliminate $1.15 billion in debt from its balance sheet. The company has accumulated substantial debt of around $1.6 billion.

Early this year, credit ratings firm S&P Global Ratings downgraded the company's credit rating, saying that its subscriber base has aged and its brand is out of favor.

WeightWatchers started as a small weekly support group focused on weight loss and rapidly evolved into a global movement, amassing millions of members worldwide.

However, the surge in the use of GLP-1 medications — like Novo Nordisk's Wegovy and Zepbound — dampened interest in the company's conventional weight-loss offerings.

After its rebrand to WW International in 2018, the company focused on overall wellness rather than just weight loss.

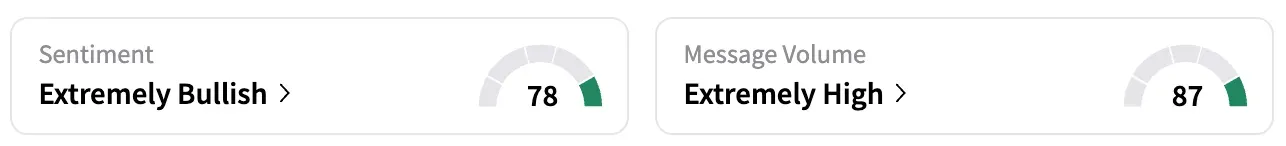

On Stocktwits, retail sentiment for WW ended on an 'extremely bullish' note late Tuesday, unchanged from a week ago.

A user noted, "Bankruptcy stocks always sky rocket after sell offs... (WW) Could triple or quadruple here this."

As of its close on Tuesday, WW stock is down 37.8% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elizabeth_warren_original_2_jpg_bd4f84b387.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212700544_jpg_8378e13131.webp)