Advertisement|Remove ads.

WeRide Narrows Losses In Q1, Announces $100M Share Repurchase Program: Retail’s Thrilled

Shares of WeRide Inc. (WRD) soared 22% on Wednesday noon after the company reported increasing revenue and a narrowing loss for the first quarter, together with a $100 million share repurchase program.

The company’s total revenue in the period was RMB72.4 million ($10.03 million), compared to RMB71.2 million in the same period of 2024.

The increase in revenue was owing to an increase in the sales of robotaxis and robosweepers in the first quarter (Q1) of 2025, which was partially offset by a decrease in the sales of robobuses and a decrease in service revenue, the company said. Revenue from the robotaxi business accounted for 22.3% of the company’s overall revenue in the quarter

Basic and diluted net loss per American depository share (ADS) in the quarter was RMB1.38, compared to a loss of RMB11.85 in the same period of 2024.

The China-based robotaxi company increased its total fleet size to over 1,200 units in the quarter.

WeRide also announced on Wednesday that its board has authorized a share repurchase program, under which the company may repurchase up to $100 million of its Class A ordinary shares, including American depositary shares, over the next 12 months.

CFO Jennifer Li said that the company's adoption of the share repurchase program reflects its confidence in its financial health and long-term outlook.

Earlier this month, WeRide and ride-hailing platform Uber Technologies (UBER) announced plans to expand their autonomous vehicle partnership to 15 additional cities over the next five years, focusing on regions outside the U.S. and China, including Europe.

In each new city, WeRide’s autonomous vehicles will operate through the Uber app, with Uber handling fleet operations.

Uber also committed to an equity investment of $100 million in WeRide in addition to its existing investment as part of the extended partnership. The investment is expected to be completed by the second half of 2025.

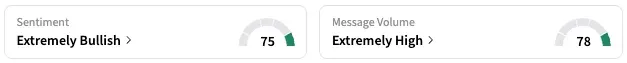

On Stocktwits, retail sentiment around WeRide jumped from ‘neutral’ to ‘extremely bullish’ over the past 24 hours while message volume rose from ‘high’ to ‘extremely high’ levels.

A Stocktwits user expressed optimism for the stock, highlighting the imminent investment from Uber and the share repurchase program.

WRD stock is down by about 27% this year. The company’s ADSs started trading on the Nasdaq in late October.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(Exchange rate: 1 RMB = 0.14 USD)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)