Advertisement|Remove ads.

Why Did Bloom Energy Stock Decline 18% On Thursday?

- Tradr also launched three other new single-stock leveraged ETFs, tracking Celestica, Nano Nuclear Energy, and Synopsys.

- Tradr aims to deliver twice the daily performance of the underlying stocks.

- Barring Synopsys, all other stocks traded lower on Thursday.

Shares of Bloom Energy (BE) declined more than 18% on Thursday and are on track for the second-largest intraday decline in 2025 so far.

Bloom Energy has been selected as one of the underlying companies for Tradr ETFs’ (Exchange-Traded Funds) latest suite of single-stock leveraged ETFs. Listed on the Cboe exchange, the Tradr 2X Long BE Daily ETF (BEX) aims to deliver twice the daily performance of Bloom Energy’s stock.

Tradr also launched three other new single-stock leveraged ETFs, tracking Celestica Inc. (CLS), Nano Nuclear Energy Inc. (NNE), and Synopsys, Inc. (SNPS).

Among these, CLS stock was trading 13% lower, while NNE shares declined 7%. Only SNPS stock was trading in the green, up 0.3% at the time of writing.

Earlier today, Synopsys’ Board of Directors approved a major restructuring plan that will result in a reduction of roughly 10% of its global workforce by the end of fiscal 2025.

What Are Stocktwits Users Saying?

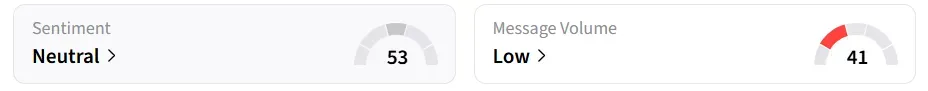

Despite the massive intraday decline, retail sentiment for BE on Stocktwits turned ‘neutral’ from ‘bearish’.

One user anticipated BE’s stock declining towards $70 if it breaks below a key support zone between $90 and $95.

This is BE’s third consecutive session of declines and its fifth in six sessions, with a short interest of 15.8% as per Koyfin data.

While the stock’s year-to-date gains stand at 365%, it has been under some selling pressure lately, declining by more than 21% over the past week.

Retail sentiment for Celestica turned ‘bullish’ from ‘neutral’ yesterday. Nano Nuclear Energy’s sentiment remained ‘bearish’ while Synopsys’ remained ‘neutral’ for the past 24 hours.

Also See: Synopsys To Cut 10% Of Workforce After Ansys Acquisition

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)