Advertisement|Remove ads.

Why Did Fluence Energy Stock Soar Nearly 15% After-Hours?

- The energy storage systems firm added that about 85% of the midpoint of the company's revenue guidance is covered by the backlog as of Sept. 30.

- During the fourth quarter ended Sept. 30, the company reported total revenue of $1.04 billion, below Wall Street’s expectations of $1.39 billion.

- Its net income of $17.9 million, or $0.13 per share, fell from $47.8 million, or $0.34 per share, in the year-ago quarter.

Fluence Energy (FLNC) stock jumped nearly 15% in extended trading after the company forecasted its fiscal 2026 revenue above Wall Street’s estimates.

The company, a joint venture between Siemens and AES Corp, projected revenue of $3.2 billion to $3.6 billion for the current fiscal year, while analysts expect $3.24 billion. The energy storage systems firm added that about 85% of the midpoint of the company's revenue guidance is covered by the backlog as of Sept. 30.

Tepid Q4 Earnings

During the fourth quarter ended Sept. 30, the company reported total revenue of $1.04 billion, below Wall Street’s expectations of $1.39 billion. Its net income of $17.9 million, or $0.13 per share, fell from $47.8 million, or $0.34 per share, in the year-ago quarter.

“The significantly higher tariff from China proposed by the Trump administration and the uncertain tariff environment overall were the primary reasons for the halt in contracting activity,” CEO Lexington May said during its third-quarter earnings call. However, the company also noted that it saw a rebound in ordering activity during the fiscal fourth quarter.

What Are Stocktwits Users Thinking?

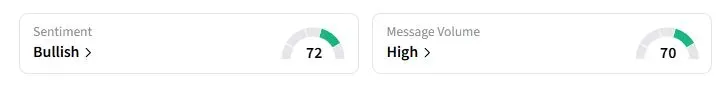

Retail sentiment on Stocktwits about Fluence moved to ‘bullish’ territory at the time of writing, compared with ‘extremely bearish’ a day ago.

“Curious to see what irons out in the call tomorrow and what the price movement is in regular hours trading tomorrow,” one trader said.

Fluence Energy and its peers are rapidly expanding their U.S. manufacturing capabilities to tap into booming demand from AI data centers. The U.S. Energy Information Administration projects that U.S. power demand will set new records in both 2025 and 2026, further straining the grid. Large-scale developers are now seeking off-grid power solutions to ensure reliable power for data centers.

Fluence Energy's stock has fallen 4.3% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)