Advertisement|Remove ads.

Why Is Amentum Stock Rising Over 9% Premarket Today?

- The company’s Global Engineering Solutions' segment revenue rose 9% for the fourth quarter, driven by new contract awards and growth on existing programs.

- The company said that as of Oct. 3, it had a total backlog of $47.1 billion, compared with $45 billion as of Sept. 27, 2024.

- “Amentum is well-positioned to benefit from tailwinds in key strategic growth areas, including global nuclear energy, critical digital infrastructure, and space systems and technology.” — Amentum Chief Executive Officer John Heller.

Amentum Holdings (AMTM) stock jumped over 9% in premarket trading on Monday after the engineering solutions firm topped Wall Street’s estimates for quarterly earnings.

On an adjusted basis, Amentum reported earnings of $0.63 per share, while analysts expected $0.59 per share, according to Fiscal.ai data. The firm’s revenue of $3.93 billion for the quarter ended Oct. 3 also topped estimates of $3.61 billion.

What Drove The Earnings?

The company’s Global Engineering Solutions' segment revenue rose 9% for the fourth quarter, driven by new contract awards, growth on existing programs, and the benefit of additional working days. At the same time, its Digital Solutions segment revenue increased 11% during the quarter.

“Amentum is well-positioned to benefit from tailwinds in key strategic growth areas including global nuclear energy, critical digital infrastructure, and space systems and technology,” said Amentum Chief Executive Officer John Heller.

What Are Stocktwits Users Thinking?

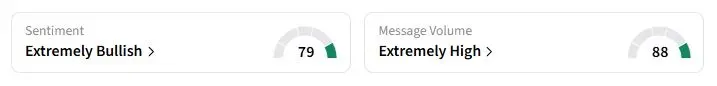

Retail sentiment on Stocktwits about Amentum was in the ‘extremely bullish’ territory at the time of writing.

“So undervalued stock...this should be at least $50, then next year will be $75-100,” one user wrote.

Backlog Soars To $47B

The company said that as of Oct. 3, it had a total backlog of $47.1 billion, compared with $45 billion as of Sept. 27, 2024, driven by $16.5 billion in net bookings. During the fiscal fourth quarter, the U.S. Space Force awarded Amentum a new $4 billion indefinite-delivery, indefinite-quantity contract with a 10-year ordering period.

The firm also nabbed a $1.8 billion contract to carry out remediation work and retrieve hazardous waste from legacy ponds on the Sellafield nuclear plant site in England. Backed by a strong backlog, the firm projected revenue of between $13.95 billion and $14.30 billion in fiscal 2026 and adjusted earnings per share of $2.25 to $2.45.

Amentum stock has gained 18.5% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)