Advertisement|Remove ads.

Will Palantir Hold Above $100 This Week? Most Retail Traders Bet On It Even As Post-Earnings Rally Cools

Palantir Technologies, Inc. (PLTR) stock was trading down over 2% by Wednesday afternoon after its 24% rally in Tuesday’s session. The post-earnings spike took the stock to an all-time closing high of $103.83 and an intraday high of $106.91.

The strong upside came after Palantir reported forecast-beating fourth-quarter results and issued upbeat guidance for the current quarter.

Wednesday’s pullback may have been due to investors taking profit and has been accompanied by below-average volume, reflecting a lack of conviction in the down move.

Cathie Wood-run Ark Invest’s flagship fund, the Ark Innovation ETF (ARKK), sold 100,804 Palantir shares on Tuesday, valued at $10.5 million (based on the closing price). The exchange-traded fund still holds $440.79 million worth of Palantir, which is its fifth biggest holding.

Palantir ended 2024 as the best-performing S&aP 500 stock due to a 340% rally, and it has added an incremental 37% so far this year. The stock now trades at a pricier forward P/E multiple of 212.77, which is viewed by some sell-side analysts as frothy.

According to TipRanks, only two of 18 analysts covering the stock have bullish ratings, while 11 remain on the sidelines and two have outright sell recommendations. Even with the post-earnings upward price target revisions, the average analysts’ price target for the stock is $86.

The consensus price target suggests a scope for about 15% downside.

But retail isn’t willing to throw in the towel yet.

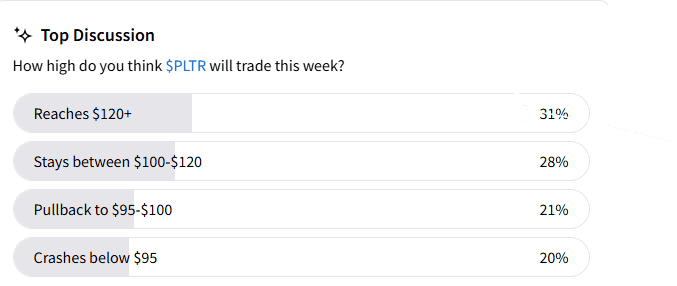

An ongoing Stocktwits poll that sought responses from users shows that 59% of respondents expect the stock to stay above $100 level this week.

Twenty-one percent braced for a pullback to a $95-$100 range, while 20% predicted a crash below the $95 level.

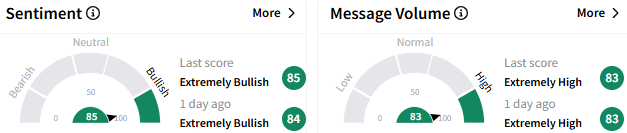

On Stocktwits, overall retail sentiment toward Palantir stock stayed ‘extremely bullish’ (84/100), with ‘extremely high’ message volume.

In response to the poll, some bears panned the valuation as irrational, while others underlined fundamental risks such as being supplanted by Nvidia Corp.’s (NVDA) NIM Enterprise and Microsoft Corp.’s (MSFT) Foundry.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)