Advertisement|Remove ads.

Workday Stock Rallies After Company Announces Workforce Reduction, Reaffirms Q4 Guidance: Retail’s Extremely Bullish

Shares of Pleasanton, California-based Workday, Inc. (WDAY) rose by the mid-session on Wednesday after the company announced a restructuring program that includes a plan to eliminate 8.5% of its workforce.

The enterprise platform provider that helps organizations manage money and manpower said the restructuring aims to prioritize its investments and continue its focus on durable growth.

The company said it is cutting about 1,750 positions and expects to exit certain owned office space. However, it also clarified that it would continue to hire in key strategic areas and locations throughout the fiscal year 2025, which ends on Jan. 31, 2026. The planned actions will likely be completed by the second quarter of fiscal year 2026.

Workday said it would incur about $230 million to $270 million in charges related to the plan, with $60 million to $70 million expected to be recognized in the fourth quarter.

Additionally, the company expects to report fiscal year 2025 and fourth quarter results in line with or above the guidance provided in late November, except for the GAAP operating margin.

Workday’s guidance calls for subscription revenue of $2.05 billion for the fourth quarter and $7.703 billion for the full year. Subscription revenue accounts for over 90% of the company’s total revenue.

Due to the restructuring plan, the fourth-quarter GAAP operating margin is now expected to be 22-23 percentage points lower than the non-GAAP operating margin. The annual GAAP operating margin will likely trail its non-GAAP counterpart by 21 percentage points.

Workday is scheduled to report its fourth-quarter results after the market closes on Feb. 25.

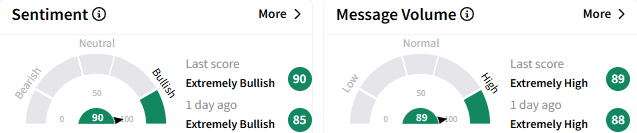

On Stocktwits, retail sentiment toward Workday stock climbed further into the ‘extremely bullish’ territory (90/100). The message volume stayed ‘extremely high.’

Workday stock climbed 4.21% to $270.66 by the mid-session. The stock is up a modest 0.7% this year after declining over 6% in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_market_OG_2_jpg_d58f0a637e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ray_dalio_resized_jpg_d2f1d535bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_490939e580.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jamie_dimon_jpmorgan_jpg_cbdd07fa63.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Git_Lab_resized_49b70b74d0.jpg)