Advertisement|Remove ads.

Zillow Stock Upgraded By KeyBanc With Price Target Hike, But Retail’s Unconvinced

Shares of Zillow Group Inc (Z) drew retail attention on Monday after KeyBanc upgraded the stock to ‘Overweight’ from ‘Sector Weight’ with a $100 price target—implying a 22% upside from current levels.

According to TheFly, KeyBanc noted that the company’s segment-by-segment revenue build and analysis show potential upside to Street estimates even when assuming no improvement in existing home sales through 2026.

The analyst also pointed out that Zillow's integrated app experience and increased penetration of enhanced markets can “continue driving mid-teens growth in a historically challenging real estate market.”

KeyBank believes Zillow is "poised for outsized margin expansion" when coupled with high incremental margins and a disciplined investment framework.

A recent market report by Zillow indicated that rented single-family homes are the housing market's big standout in current times, with costs 20% higher than that of a typical multi-family apartment. Single-family rents are up 41% since before the pandemic, compared to 26% on multifamily rents, the report said.

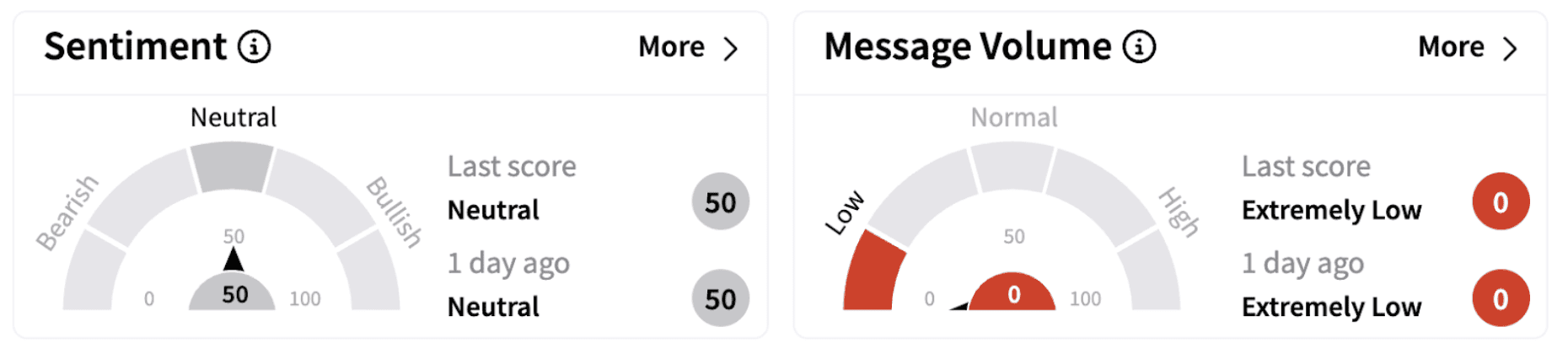

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory.

Zillow believes that slowly declining mortgage rates in 2025 will lead to gradual sales and home price appreciation growth. The firm believes home sales will rise to 4.16 million in 2025, while home values are expected to increase 2.2% over the year.

The company is scheduled to report earnings on Feb. 11, with Wall Street expecting earnings per share of $0.26 on revenue of $538.29 million.

Shares of Zillow have gained over 12% year-to-date, while the stock has risen over 46% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/incyte_resized_jpg_4f94b32a2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lantheus_jpg_e10c71c486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)