Advertisement|Remove ads.

Capricor Therapeutics Stock Surges Over 35% Pre-Market As Retail Turns ‘Extremely Bullish’ On DMD Drug Filing Plans

Shares of Capricor Therapeutics (CAPR) soared over 35% pre-market on Tuesday, continuing strong momentum from the previous session, and made retail investors quite optimistic.

The spike follows the company’s announcement that it plans to file a Biologics License Application (BLA) for its Duchenne muscular dystrophy (DMD) cardiomyopathy treatment, deramiocel, after recent meetings with the U.S. Food and Drug Administration (FDA).

Capricor intends to start filing the BLA in October 2024, aiming for full approval by year-end. The application will be based on existing cardiac data from the Phase 2 HOPE-2 and HOPE-2 Open Label Extension trials, along with natural history data from Vanderbilt University Medical Center and Cincinnati Children’s Hospital.

The company also revealed that Cohorts A and B from its ongoing Phase 3 HOPE-3 trial will serve as a post-approval study to potentially expand the label to include DMD skeletal muscle myopathy.

Oppenheimer on Monday reiterated its ‘Outperform’ rating on the stock, and predicted that Capricor’s update would likely indicate the possibility of accelerated approval for deramiocel.

The brokerage views the drug’s cardioprotective benefits as key for pricing and reimbursement, given the lack of approved treatments for DMD-associated cardiomyopathy.

The stock’s rally was further fueled by Capricor’s recent agreement with Nippon Shinyaku for commercialization of deramiocel in Europe, which includes a $20 million upfront payment, plus potential milestone payments of up to $715 million and a double-digit share of revenue.

Duchenne muscular dystrophy is a rare genetic disorder that weakens muscles, with a U.S. patient population of roughly 15,000-20,000.

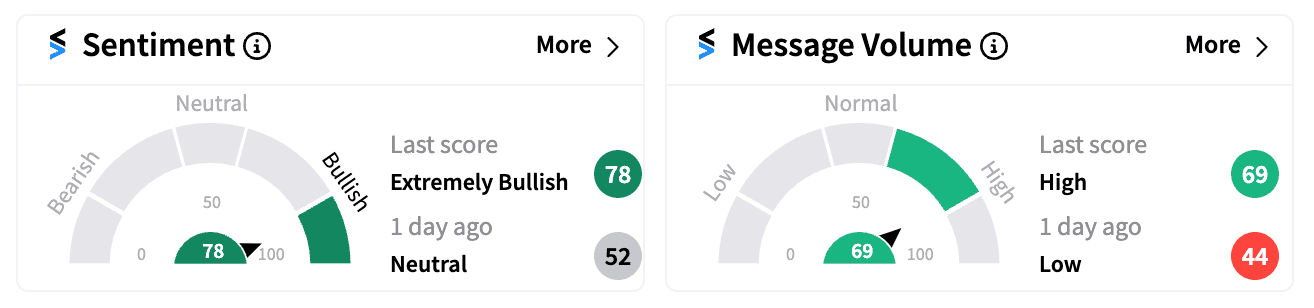

Retail sentiment for CAPR stock has surged to ‘extremely bullish’ (78/100) on Stocktwits, with a significant rise in message volume as excitement builds around Capricor’s FDA filing plans.

Capricor stock has gained approximately 16% year-to-date.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)