As we wrap up and head off to enjoy our weekend, it seems appropriate to highlight some big movers from the week that you may have missed.

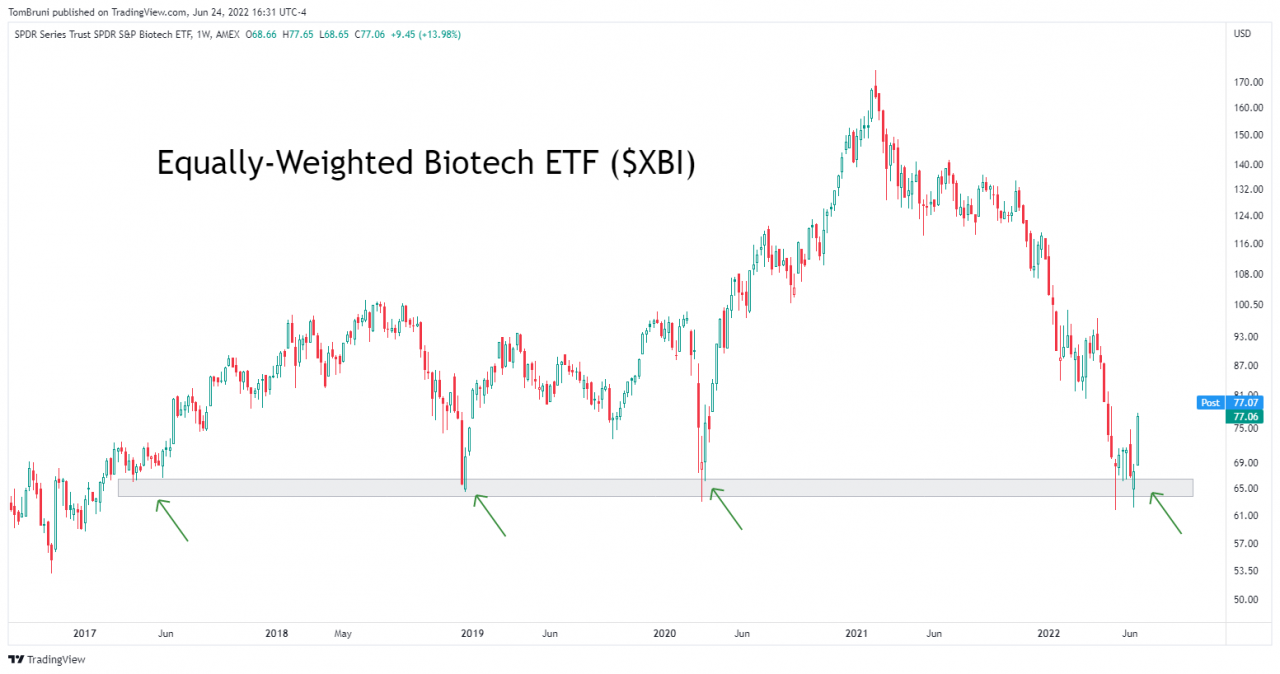

The equally-weighted biotech ETF $XBI was up a cool 13.98% this week, buoyed by some M&A activity.

Technical analysts are pointing to the ETF rebounding at the same level it has back to mid 2017. Meanwhile, fundamental analysts are pointing to measures that suggest the sector has gotten cheap overall given many companies’ major cash piles.

Additionally, while everyone in the commodity market is focused on oil and energy-related futures, there are some big moves happening elsewhere.

Copper was down 6.96%, its third week in a row of losses, and settled at 16-month lows.

Meanwhile, agricultural commodities like Wheat, Soybeans, Corn, and others are quietly coming off their highs.

Cotton had its second major down week, falling nearly 30% since the start of June.

The move lower in commodities may be coming as the market reassesses demand amid rising recession fears. As they like to say in the commodities markets, “the cure for higher prices is often higher prices.“