Commodities were the best performing asset class in the year’s first half, but some cracks are beginning to form in the “commodity supercycle” thesis. 📉

Today crude oil broke back below $100/barrel, with gasoline, heating oil, and natural gas trading well below their highs. 🛢️

“Dr. Copper,” which many use to forecast the economy, is working on its fifth consecutive weekly decline and trading at levels not seen since November 2020. 🏭

Corn, soybeans, wheat, and several other agricultural commodities have declined by 20%+ in recent weeks. 🚜

Supply has improved in several cases, but much of the recent declines have come on the fear that demand will drop drastically in a recession.

It seems like everyone is talking about a recession these days. Today the Bank of England told lenders to “brace for an economic storm.” ⛈️

And while many had hoped commodity prices would come down, prices falling due to a recession and massive drop-off in demand is not the ideal path. 👎

We’ll see how these trends play out in the coming weeks and months.

The debate remains whether these are sharp pullbacks within a secular trend higher in commodity prices. Or if we’ve indeed seen a meaningful peak in many of them. 🤔

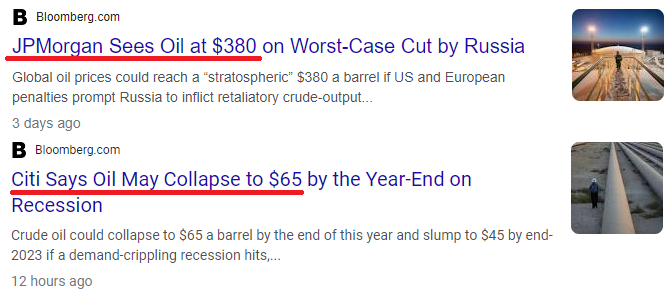

As always, Wall Street analysts know exactly what’s next. We’re kidding, of course. 😂

Since we’re all just guessing anyway, head over to the streams and let us know your thoughts! 💭