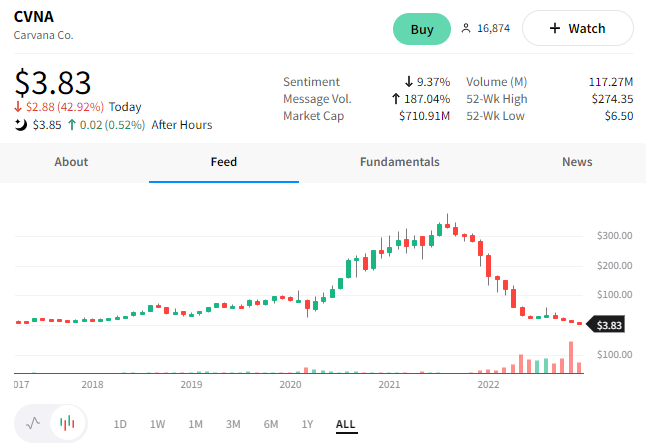

Shares of online car retailer Carvana fell to a fresh all-time low as bankruptcy fears spread. 😱

The company reportedly signed a pact with creditors who hold roughly 70% ($4 billion) of its unsecured debt. The binding deal requires its creditors to act together in negotiations with the company. This could potentially streamline the negotiation process where Carvana can seek to restructure debt or secure new financing.

After the news broke, Wedbush analyst Seth Basham downgraded the stock from neutral to underperform. He also reduced his price target from $9 to $1. He joins the group of other analysts who continue to throw in the towel on the stock. Other analysts, however, downplayed the rumors and said the company has a sufficient short-term cushion to get through the end of 2023.

The bears remain in the driver’s seat for now, with $CVNA shares falling another 43% today… 📉