Stocks experienced some relief after falling eight of the last nine sessions — let’s catch you up. 👀

Today’s issue covers the potential trough in continuing jobless claims, Express and Momo’s big moves, and other earnings highlights. 📰

Check out today’s heat map:

9 of 11 sectors closed green. Technology (+1.63%) led, and Energy (-0.48%) lagged. 💚

Microsoft and Activision Blizzard both fell on the news that the FTC is suing to block their deal. 🚫

In crypto news, the Senate Banking and House Financial Services committees plan to subpoena FTX’s Sam Bankman-Fried if he does not testify voluntarily. The Securities & Exchange Commission (SEC) issued new guidance requiring companies to disclose digital currency risks. FTX spokesman Kevin O’Leary says he lost his $15 million payout from the firm. And a federal judge dismissed the crypto scam lawsuits against Kim Kardashian and other celebrities. ₿

Other symbols active on the streams included: $GME (+11.37%), $MMAT (-10.73%), $MMTLP (-58.64%), $MULN (-0.52%), $COSM (-25.21%), $SMMT (+17.21%), $CVNA (+29.50%), and $PHVS (+356.57%). 🔥

Here are the closing prices:

| S&P 500 | 3,964 | +0.75% |

| Nasdaq | 11,082 | +1.13% |

| Russell 2000 | 1,818 | +0.63% |

| Dow Jones | 33,781 | +0.55% |

Initial and continuing jobless claims come out every Thursday, so they rarely get much attention. That’s been particularly true given the strength in the overall labor market.

With that said, today’s numbers had people talking because continuing unemployment claims rose to a 10-month high. Although the data experiences some seasonal volatility this time of year, the data has clearly flattened out and begun rising over the last six months. 📈

For your reference, the tradingeconomics.com chart below shows continuing jobless claims over the last 1.5 years.

This potential trough has given the market some hope that the red-hot labor market could begin cooling soon. Some pushback to that argument is that jobless claims remain near historically low levels. But at this point, the Fed and market bulls will take what they can get.

For now, we’ll have to wait and see whether or not this truly is a seasonal blip or if this is a true trend reversal. 🤷

Sponsored

The Startup Making Vacation Rental Ownership Possible for Anyone

Most people don’t have the time or money to buy and manage vacation rental properties.

reAlpha is lowering those barriers to entry.

How?

The startup is sharing access to the $1.2T short-term rental market by buying and managing properties, then giving millions of people the opportunity to become part-owners in them through an app-based platform.

But as they build their portfolio of properties using a $200M financing facility – the largest in the industry’s history – you have an opportunity to become a shareholder in the company itself.

But hurry, the opportunity ends tonight at midnight PST!

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.

Earnings

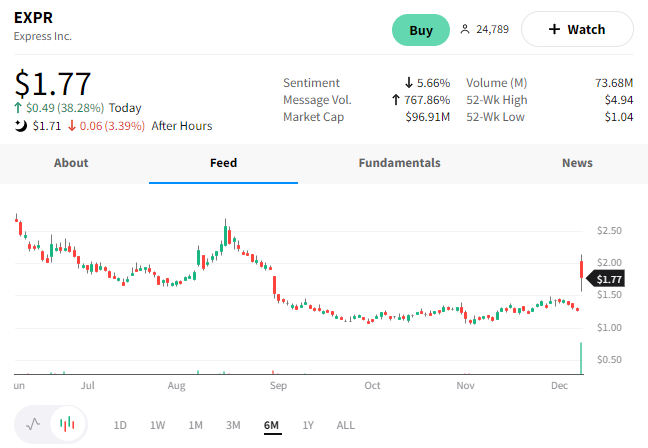

Express Gains Momo-mentum

Express has been barreling down the tracks in the wrong direction for some time. But today, the stock is popping after reporting earnings and inking a new joint venture with WHP.

On the revenue front, the retailer saw Q3 sales fall 8% YoY to 434.1 million, falling short of the $451.77 million expected. Comparable sales, including Express stores and eCommerce, were down 11%, as online demand fell 17%. Comparable outlet store sales were flat as consumers traded down to lower price points. 🔻

Operating expenses rose 6.8% YoY, with gross margins falling 540 bps to 27.8%. This led to a wider-than-expected loss per share of $0.50 vs. the $0.29 expected.

The earnings left a lot to be desired. But what caught investors’ attention was its “mutually transformative strategic partnership’ with WHP Global. According to a quick google search, the New York-based firm acquires global consumer brands and invests in high-growth distribution channels, including digital commerce platforms and global expansion. 🤝

WHP will invest $25 million to acquire roughly 7.4% pro format ownership in Express. And they will partner together in an Intelectual Property Joint Venture valued at roughly $400 million. Under the deal, WHP will own 60%, and Express will own 40%.

Based on today’s action, it appears investors are optimistic that this partnership can help put Express back on a better path. $EXPR shares rose 38% and closed near a 3-month high. 📈

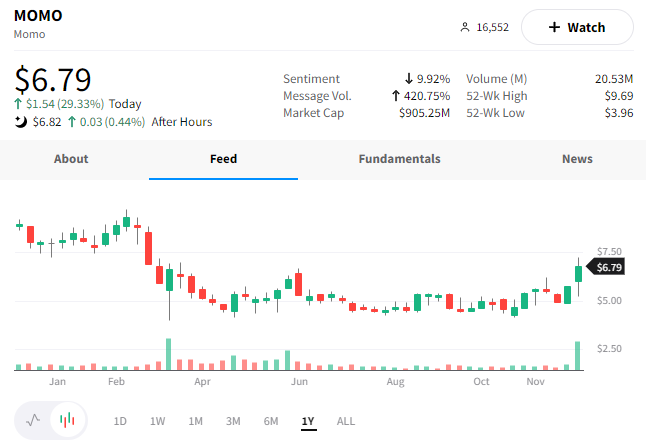

Meanwhile, Hello Group Inc. also rose 30% today after reporting better-than-expected earnings. 👍

Its earnings per share of $0.37 beat expectations of $0.29. Meanwhile, the software company also beat revenue estimates by 2.93% at $454.49 million.

The results pushed $MOMO shares to an eight-month high. But we really just needed to mention it so we could use the ticker in the title. 😄

Earnings

Earnings Recap – 12/08

In addition to those discussed above, several other stocks moved on earnings today. Let’s recap.

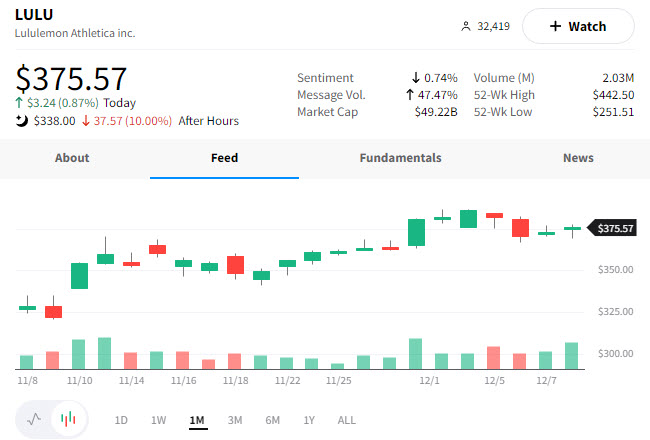

Lululemon lost its leggings this quarter. The stock was down as much as 10% despite beating earnings and revenue expectations.

Net revenue increased by 28%, and gross profits jumped by 25% to $1 billion. And comparable store sales of 22% beat the 19% expected.

However, $LULU shares are falling on weaker-than-expected fourth-quarter earnings and revenue guidance.

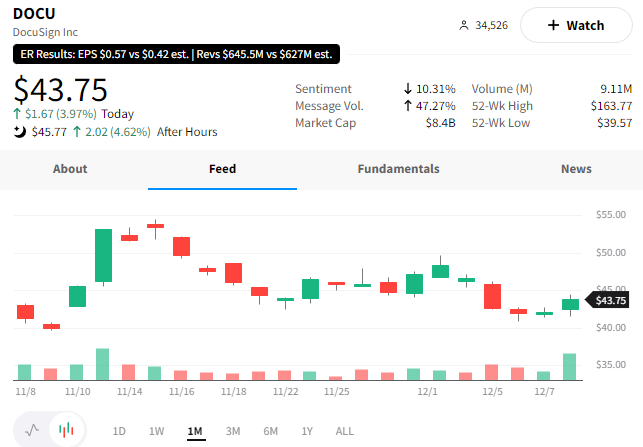

Docusign looks more like Docu-win today after it reported better-than-expected earnings and revenue.

The third quarter was a loss for Docusign, but that’s not what investors were focused on. Total revenue and subscription revenue were higher by 18%, and a 27% jump in professional services and other revenue YoY.

With all the bankruptcies from the dumpster fire that the crypto market has been in, maybe Docusign has been extra busy. But, more seriously, any improvements in the struggling software business are a welcome sign for investors.

As a result, investors pushed $DOCU shares higher after hours to the $50 mark, a +15% gain. However, it’s fallen a good amount to the $45 and $46 range (+5%) since then.

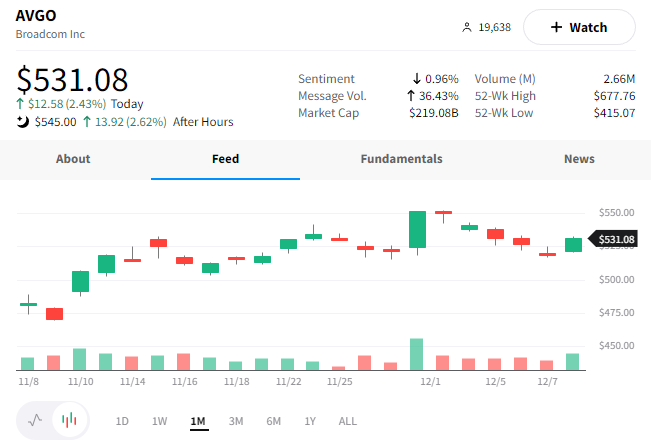

Broadly winning is the phrase to describe Broadcom after its earnings came out.

Revenue rose 21% YoY to 8.93 billion, and earnings per share of $10.45 also beat expectations.

Investors were happy to see the positive results despite the drop in smartphone shipments this year. The company expects its VMware deal to grow its software business, helping diversify it away from harder-hit areas of the chip market industry. As a result, its first-quarter revenue guidance was boosted by 16%, raising its dividend by 12%.

$AVGO shares are up about 4% after hours.

Bullets

Bullets From The Day:

🍨 Candy maker Ferrero acquires ice cream brand Halo Top. The company is buying Wells Enterprises, which owns Blue Bunny, Blue Ribbon Classics, and Halo Top. It was originally founded in 1913 and is currently the second-largest ice cream company in the U.S., behind Ben & Jerry’s parent Unilever. The acquisition comes as food sales soared through the pandemic and continue to rise. Neither company disclosed the financial terms of the deal. CNBC has more.

🧑⚖️ EU to force Google to remove ‘manifestly inaccurate’ data. Europe’s top court ruled that Alphabet’s Google must remove data from online search results if users can prove it is inaccurate. To avoid excessive burden on users, the judges ruled that users only have to provide evidence that can reasonably be required of them to find (though we’re not sure that helps much…). This comes as the debate on free speech and privacy rights remains at the center of discussion in the technology and media sector. More from Reuters.

🗺️ Google merges Maps and Waze product teams to stay on course. Big technology companies are ramping up their efforts to cut costs in the weaker economic climate. Today, Google announced that it would merge teams working on its mapping service Waze and products like Google Maps. Waze CEO Neha Parikh will exit the company shortly after a transition period, but Waze will continue to operate as a standalone app. The service has roughly 151 million users but has struggled to grow since being acquired by Google. Reuters has more.

🤑 Twitter will charge iOS users more to offset App Store fees. The battle against Apple’s App Store fees continues, with Twitter reportedly planning to charge iOS users more for Twitter Blue to offset the 30% fee charged by Apple. The two companies have clashed over the last few weeks, with Apple pausing ads on Twitter and threatening to remove the app from its store. With that said, things seem to be back on track after Musk and Cook met in person last week. However, it’s unlikely the last we’ll hear of the situation. More from TechCrunch.

💳 Wirecard fraud trial begins. The payments company’s former CEO, Markus Braun, is standing trial for fraud two years after his company collapsed and shocked Germany’s business world. Braun has denied embezzling money and accused others of running the shadow operation behind his back. With that said, a conclusion is not expected until at least 2024, with him facing up to 15 years in prison if convicted. Reuters has more.

Links

Links That Don’t Suck:

💰 Manhattan renters face sticker shock with average rent at $5,200

🍴 Nutritionists share the one veggie you should eat every day

⚖️ Ex-Theranos president Balwani sentenced to nearly 13 years of fraud

😮 Olive Garden manager fired for time-off message: ‘If your dog died, bring him in’

🏭 Elon Musk taps Tesla’s China chief to run Texas gigafactory – Bloomberg News

🤝 Brittney Griner released by Russia in 1-for-1 prisoner swap for arms dealer VIktor Bout

🌬️ First offshore wind power sites auctioned off California’s coast. One day it could power 1.5m homes.