Stocks narrowly avoided their worst week since September — let’s see what had markets moving. 👀

Today’s issue covers what’s feeding the rise in producer prices, the SEC’s response to the crypto turmoil, and some unbe-li-evable earnings movers. 📰

Check out today’s heat map:

Only one sector closed green. Communication services (+0.29%) led, and energy (-2.38%) lagged. 💚

Oil prices remained slick despite the Keystone pipeline shutting down after a 14,000-barrel oil spill. Meanwhile, U.S. oil giants are enjoying record profits, causing them to ramp up investment plans next year. And despite blowback from the public, many are returning cash to shareholders, with Exxon Mobil raising its buyback to $50 billion. 🛢️

Apple iPhone shipments are facing difficult times due to continued lockdowns in China. 📱

Micro-cap Ambrx BIopharma rose over 1,000% on encouraging preliminary safety and efficacy data for its breast cancer drug … 😮

In crypto news, SBF is under investigation by Federal prosecutors for collapsing Terra’s Luna and the stablecoin, TerraUSD. Speaking of stablecoins, Coinbase is now encouraging customers to convert their Tether into USD Coin, citing reserve quality. 🪙

Other symbols active on the streams included: $MOMO (+31.52%), $MARA (-7.24%), $LULU (-12.85%), $AMC (-2.14%), $MMAT (-22.40%), $MMTLP (-58.64%), $BA (+0.26%), $CVNA (+1.81%), $ORGN (-1.09%), $BXRX (+27.76%), and $TSLA (+3.23%). 🔥

Here are the closing prices:

| S&P 500 | 3,934 | -0.73% |

| Nasdaq | 11,005 | -0.70% |

| Russell 2000 | 1,797 | -1.15% |

| Dow Jones | 33,476 | -0.90% |

November’s producer price index (PPI) came in higher than expected, rising by 0.3% MoM and 7.4% YoY. 🔥

The culprit this time? Wholesale vegetables…which saw a 38% surge. This caused the overall food index to rise 3.3%, which offset the 3.3% decline in energy costs.

Core PPI doubled the 0.2% MoM estimate at 0.4%, excluding food and energy. While the YoY rise of 6.2% is less than October’s 6.6% reading, inflation remains far too high for the Fed’s liking.

The news sent bond yields, which had been trending lower for a few weeks, higher. The Fed says they’re staying aggressive until inflation comes down meaningfully, and today’s reading was anything but that.

Meanwhile, China’s producer prices fell overseas in November as inflation cooled consumer demand. Weak activity and soft demand in the world’s second-largest economy remain a concern for investors. 📉

Oof. Crypto can’t catch a break.

The collapse of FTX must have been the final straw for the SEC. Some new guidance came out yesterday, specifically related to crypto and corporate public filings.

The SEC pushed out a Sample Letter to Companies Regarding Recent Developments in Crypto Asset Markets

In a nutshell, the SEC wants companies to report some additional details with their public filings:

- Describe how any cryptocurrency bankruptcies have impacted their business directly or indirectly.

- Include exposure to cryptocurrency assets and holdings.

- Include exposure, if any, to FTX’s bankruptcy and any other major market developments.

The full letter contains 16 points the SEC wants more information on.

And speaking of the FTX collapse, Sam Bankman-Fried says he’s willing to testify at a U.S. House hearing, even though he missed the response deadline. Whether or not that happens remains to be seen, but he’s sure spending a lot of time in the media these days…

Earnings

Unbe-li auto-vable Earnings Moves

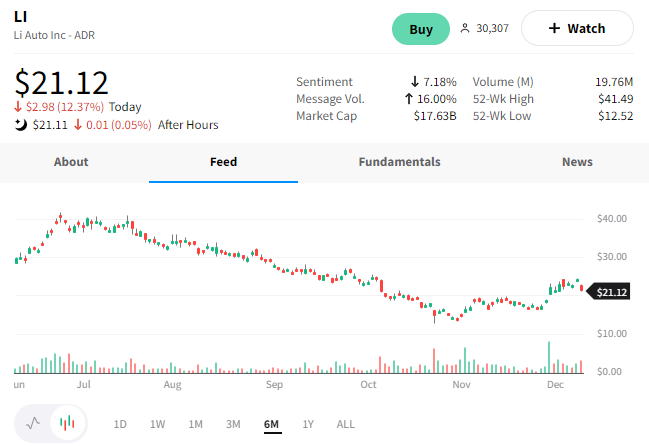

Chinese electric vehicle maker Li Auto veered off course today after missing earnings estimates.

The company saw revenues rise 20.25 YoY to $1.31 billion, missing estimates of $1.40 billion. Its Non-GAAP net loss per share was greater than expected at $0.18 vs. $0.15. ⚡

Getting into delivery numbers, Q3 rose 5.6% YoY to 26,524 vehicles. However, that represents a 7.5% QoQ decline.

More concerningly, its vehicle margin fell 910 bps YoY to 12%. Contracting margins pressured gross profit, which fell 34.8% YoY. Its gross margin contracted by 1,060 bps to 12.7%. 🔻

To become profitable again, the company’s chief engineer will replace its president and director, who recently resigned. The company is also rationalizing its costs and ramping production to benefit from economies of scale. However, they recognize they’re doing so in the face of an uncertain macro environment and supply chain issues.

Despite the challenges, management remains optimistic about their ability to execute and deliver 45,000-48,000 vehicles in Q4.

With that said, investors appear less confident as $LI shares fell 12% on the day. 📉

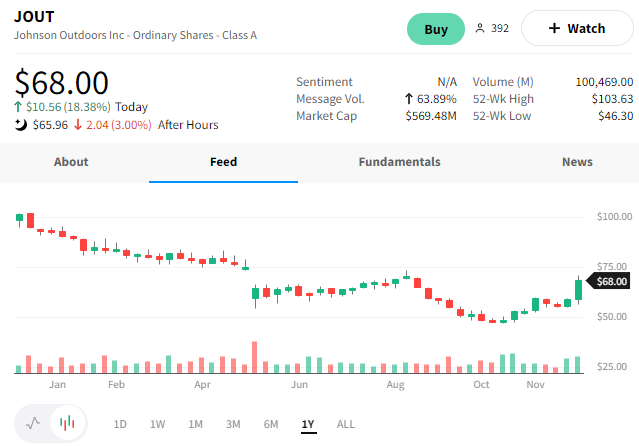

Meanwhile, small-cap outdoor recreational products retailer Johnson Outdoors surprised analysts with better-than-expected earnings. 😮

The company saw Q4 sales growth of 18% YoY to $196.39 million vs. the $168.57 million expected. Earnings per share of $0.95 also beat consensus expectations of $0.37 by a wide margin. 💪

Like other retailers, the company is dealing with gross margin contraction. However, they note the 620 bp YoY decline to 34.9% is primarily due to increased material costs and inventory reserves.

Overall operating expenses were up just 1% YoY, and operating margins of 6.8% were higher than expected. With that said, the company does expect supply chain constraints to occur periodically in 2023. And margins will remain impacted by higher prices.

Overall, investors seemed happy with the results. $JOUT shares rose 18% on the day. 👍

Bullets

Bullets From The Day:

🏦 U.K. tries to spur growth by revamping its financial sector. If you thought that Brexit was all done and over with, it isn’t. The U.K. is looking at over 30 current regulatory measures, many of which came post-2008, that “choke off growth.” Some changes target banks’ retail and investment arms and penalties involving individuals. All in an effort to make the U.K. “one of the most open, dynamic and competitive financial services hubs in the world.” says Finance Minister Jeremy Hunt. CNBC has more.

💰 Credit Suisse raises $4.3 billion as turnaround plan accelerates. The new raise is intended to help reverse the billions in losses suffered from fund outflows and legal woes. A planned restructuring proposes that the bank split and spin off its investment banking unit and focus on its wealth business. Credit Suisse also plans to lay off a further 9,000 people by 2025. More from Reuters.

❌ Twitter plans to delete 1.5 billion inactive accounts. Elon Musk said the accounts affected have little to no tweeting history and/or have no logins for years. Additionally, accounts that have been inactive for 15 years will also be purged. Has Twitter really been around that long? Gosh I need to spend less time on the internet…lol. Business Insider has more.

💳 Walmart-backed fintech startup plans BNPL (Buy Now, Pay Later) launch. The new entity called One is scheduled to start sometime in 2023. Analysts say that one (no pun intended) of the biggest names in the BNPL space, Affirm ($AFRM), is experiencing some selling pressure as a result of this news. More from CNBC.

🗳️General Motors battery plant workers vote to unionize. Workers at the Warren, Ohio Ultium Cell LCC plant overwhelmingly voted to join the United Auto Workers Union (UAW). Ultium initially declined to recognize the union through a card check. The CEO says a deal with the union would be reached as soon as possible. CNBC has more.

Links

Links That Don’t Suck:

📈 Get IBD’s Online Investing Courses for the holidays and score the lowest prices of the year*

🤒 Scientists finally know why people get more colds and flu in winter

🪐 NASA Ingenuity helicopter just broke one of its own records on Mars

🪸 Marine life hit by ‘perfect storm’ as red list reveals species close to extinction

😱 Johnny Knoxville sued over home prank … you traumatized me!!!

🤣 British danger tourist ‘illegally crossed borders’ to see girlfriend and got dumped

🛣️ President of the UK Roundabout Appreciation Society explains why he loves roundabouts so much

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.