Stocks continued their winning streak as the Fed paused their rate hikes but kept a hawkish underlying tone. 👀

Let’s recap and prep you for the shortened week ahead. 📝

What Happened?

🐂 The stock market continues its rally, with the Nasdaq 100 rising for the eighth straight week. The tech sector ETF is eyeing all-time highs on the back of mega-cap technology stocks and semiconductors.

🤩 This week’s Stocktwits Top 25 report showed mixed performance relative to the indexes.

⏯️ U.S. inflation measured by the CPI and PPI continues to trend lower, though core values remain elevated and sticky. Despite that, the Fed was happy enough with the progress to “skip” this month’s rate hike but signaled that it expects two more before the end of 2023. Meanwhile, the U.S. economy continues to hum along.

🥙 CAVA’s IPO priced above its expected range and doubled on its first day of trade, marking the first significant appetite for new offerings in over a year.

₿ The U.S. Securities and Exchange Commission (SEC) remains under fire as lawmakers take aim at Gary Gensler. Meanwhile, the world’s largest asset manager, BlackRock, feels it has cracked the code to get a Spot Bitcoin ETF approved.

📰 Other stories worth noting include M&A news, the media industry’s state, Lennar’s read on housing, Cannabis stocks going up in smoke, and why some believe investors are sleeping on commodities.

🔥 Several names were on the Stocktwits trending tab for most of the week, including $MVIS, $MULN, $NVCR, $SOFI, and $NKLA.

Here are the closing prices:

| S&P 500 | 4,410 | +2.58% |

| Nasdaq | 13,690 | +3.25% |

| Russell 2000 | 1,875.47 | +0.12% |

| Dow Jones | 34,299 | +1.25% |

Bullets

Bullets From The Weekend

😮 National debt tops $32 trillion for the first time. The milestone comes less than two weeks after President Joe Biden signed the Fiscal Responsibility Act of 2023, which raised the debt ceiling until January 2025 and trimmed a projected $1.5 trillion over a decade. Total public debt outstanding reached $30 trillion for the first time in early 2022, hitting $31 trillion less than nine months ago. Both sides of the aisle are concerned about the nation’s debt, but neither will tackle its biggest drivers because they’d be politically unpopular. Yahoo Finance has more.

🏭 Intel invests a record $25 billion in Israel. The U.S. chipmaker is building a new factory in Israel, marking the largest-ever international investment in the country. It will open in 2027 and operate through 2035, creating thousands of jobs and having the company pay a 7.5% tax rate (up from the current 5%). Governments around the globe continue to court the world’s largest companies as they diversify their supply chains and operations away from China. More from Reuters.

✈️ Paris Air show indicates jet demand remains hot. The conference returns this week after a four-year hiatus during the pandemic, with experts expecting there could be 2,100 aircraft orders generated during it. As travel demand rebounds, airlines are working hard to upgrade their fleets that are either too small or aging. Meanwhile, Boeing and Airbus are struggling to keep pace as supply chain issues continue to hamper progress. CNBC has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

Economic Calendar

It’s a short but busy week of economic data, with many Fed officials speaking publicly and housing market data coming out. In addition to the above, check out this week’s complete list of economic releases.

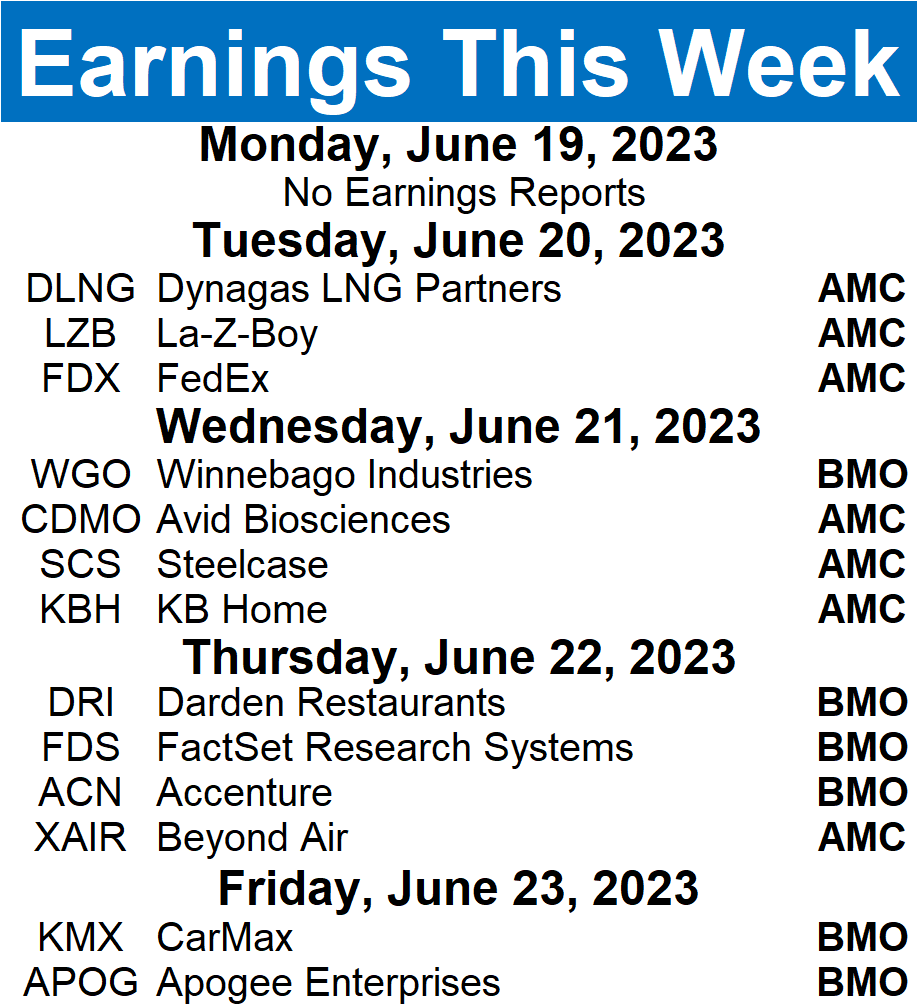

Earnings This Week

Earnings season is essentially finished, with just 21 companies reporting this week. Some tickers you may recognize are $FDX, $KBH, $KMX, $ACN, $LZB, $DRI, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

🖼️ Beeple says it’s time to delete your JPEGs — here’s why

📺 Elon Musk says Twitter video app for smart TVs is ‘coming’

😂 Three of the biggest Reddit communities reopened in the funniest way possible

🏎️ Toyota’s first electric sports car aimed to be indistinguishable from a gasoline one

🛻 These tiny Japanese pick-up trucks that cost about $5,000 are winning fans in America

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.