It was another turbulent week for stocks, as big tech earnings pulled the market lower ahead of next week’s Fed decision. 🦅

Let’s recap and prep you for the week ahead. 📝

What Happened?

📉 Stocks declined again this week amid a mixed earnings picture. Microsoft, Google, and Amazon all put “the cloud” in focus for technology investors, with their performance and outlook driving overall sentiment. Meanwhile, Meta’s “across the board” beat was not enough to escape the selling.

🤩 This week’s Stocktwits Top 25 report showed underperformance relative to the indexes.

💵 Bonds were in focus, with Bill Ackman and Bill Gross sharing their views on the economy and interest rates. That weighed on sentiment, as many reassessed whether a U.S. recession could be ahead. In the stock market, small-caps tried to dig in at potential support but closed on their lows.

🛢️ Energy stocks came under pressure as lower refining profits and natural gas prices weighed on their results. Overseas, Siemens Energy sought government support as trouble in its wind subsidiary continues to drag its financial position (and stock price) to new lows.

🤝M&A activity picked up as companies look to announce ahead of earnings, where management must provide more insights into their deals. And the fanfare around semiconductors continued, with Japanese semiconductor equipment maker Kokusai Electric rising 32% in its debut on the Tokyo Stock Exchange.

🎧 Spotify popped this week after returning to profitability in a quarter that its CFO called “an inflection point.”

📰 Several other stocks made headlines, including Deckers Outdoor, Barnes Group, Deutsche Bank, and cocoa prices (admittedly, not a stock).

🔥 Several names were on the Stocktwits trending tab for most of the week, including $COIN, $SAVA, $ENPH, $SOFI, $NVOS, and $BTC.X.

Here are the closing prices:

| S&P 500 | 4,117 | -2.53% |

| Nasdaq | 12,719 | -2.04% |

| Russell 2000 | 1,637 | -2.61% |

| Dow Jones | 32,418 | -2.14% |

Bullets

Bullets From The Weekend

🏢 Biden administration looks to unlock more office-to-apartment conversions. It released a toolkit highlighting more than 20 federal programs designed to make converting buildings easier as the country looks to tackle its ongoing housing crisis. With U.S. office vacancies hitting 30-year highs, many economists believe that transforming them into housing could help add more supply to the market. However, these types of conversion are complex, requiring considerable time, money, and effort, making them financially feasible in only a few metro areas. Axios has more.

🤔 What to expect from Apple’s online-only launch on October 30th. The company is looking to trick the market by delivering an unexpected treat at its “Scary Fast” event, with many anticipating the brand-new M3 processors for its updated Macs could be revealed. It finished rolling out its M2 chips earlier this year and is now moving onto M3 chips, reportedly built on TSMC’s 3nm process, making a faster and more efficient product. The chips could supercharge the iMac as the company refreshes its desktop for the first time in years. More from The Verge.

🤝 Stellantis reached a tentative deal with the United Auto Workers (UAW) union. The agreement between workers and the Jeep Maker mirrors the one reached with Ford earlier in the week, leaving only GM without a union agreement. As a result, the UAW is ramping up its pressure against General Motors, escalating strikes by adding a plant in Tennessee and bringing the total to 18,000 workers. Meanwhile, about 14,000 UAW workers on strike against Stellantis were told to return to work as the deal heads to a vote. Yahoo Finance has more.

The Brief

Need a concise summary of what’s going on this week? Look no further. Here’s an overview of important earnings and economic data for the trading week ahead.

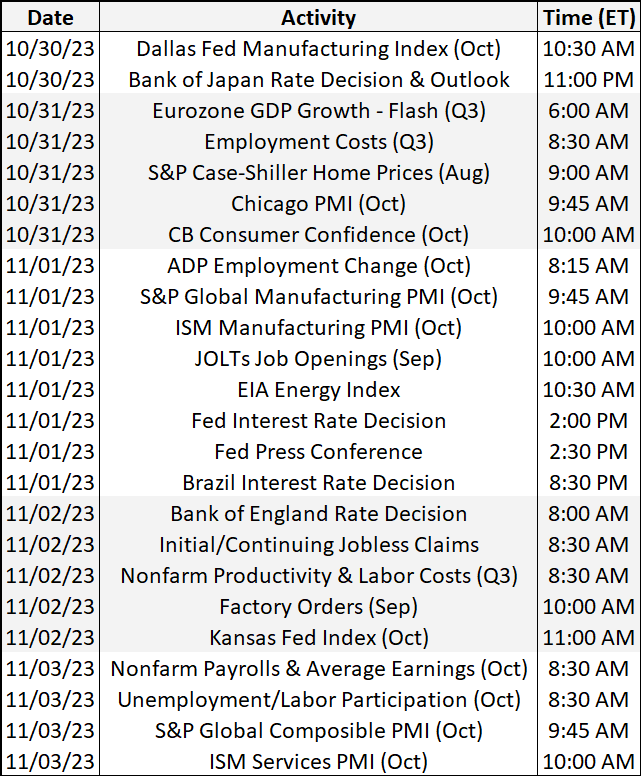

Economic Calendar

It’s a busier week on the economic data front, with investors focused on the Federal Reserve’s (and other central banks’) interest rate decisions. In addition to the above, check out this week’s complete list of economic releases.

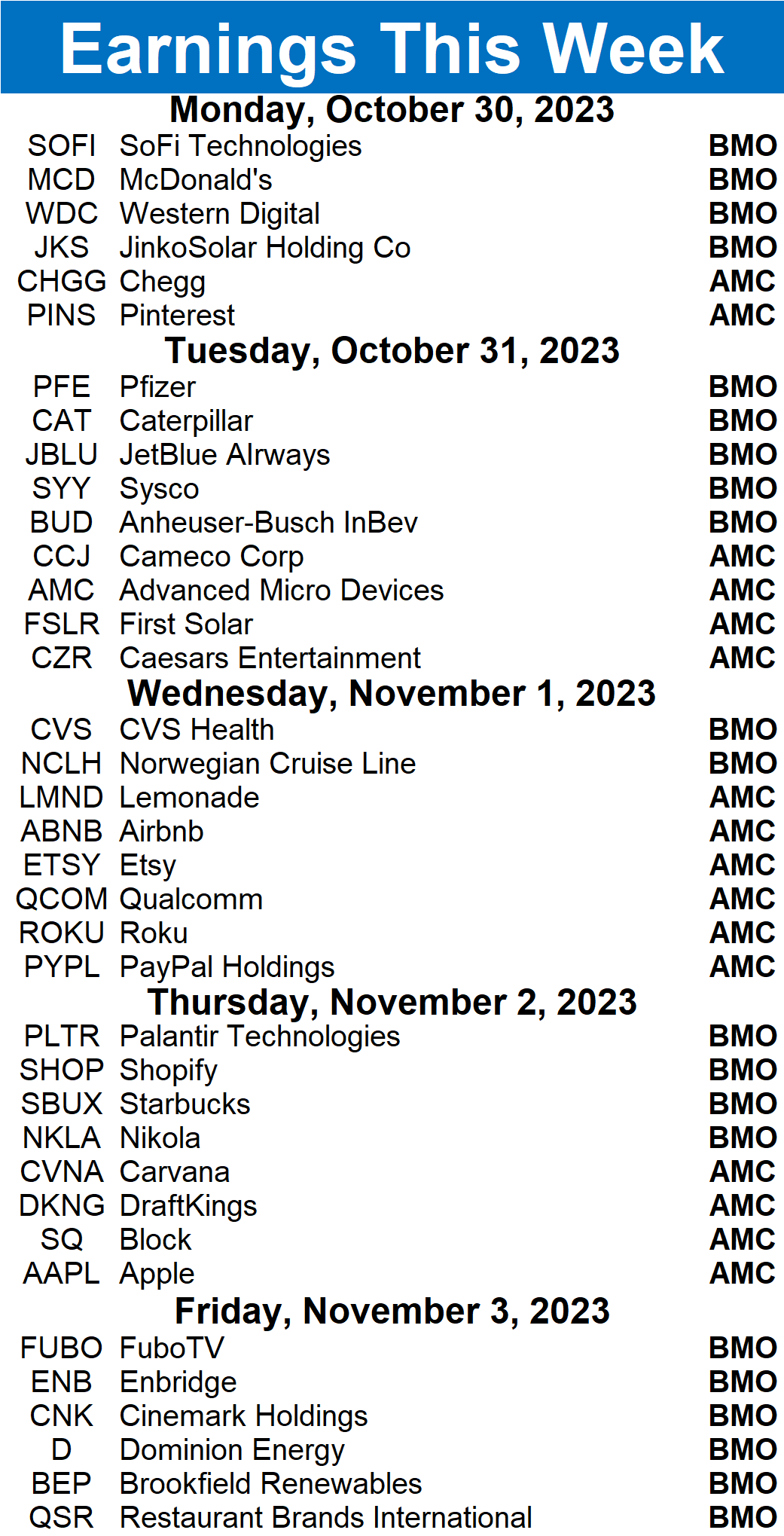

Earnings This Week

Earnings season has officially ramped up, as 1,025 companies report this week. Some tickers you may recognize are $AAPL, $SOFI, $MCD, $ABNB, $PYPL, $SQ, $CVNA, $BUD, and more.

Above is a quick summary. Check out the full Stocktwits earnings calendar for the other names reporting this week.

Links

Links That Don’t Suck:

📱 Instagram head says Threads API is in the works

₿ Gemini is suing Genesis in GBTC collateral dispute

🌐 Your guide to the internet’s most (and least) important moments

⚡ 1st autonomous, electric aircraft in the world to get approval for commercial flights

*3rd Party Ad. Not an offer or recommendation by Stocktwits. See disclosure here.