The market today for crypto was a little mixed, and you’ll notice that in the performance table below. Bitcoin ($BTC.X) closed higher by nearly 3%, but Ethereum ($ETH.X) was down a little over -2%. Today’s big winner was Solana ($SOL.X), gaining more than 7% for the day.

Overall, the total market cap – due to Bitcoin’s performance – rose, but the altcoin market fell – due to Ethereum. Lots of ups and downs across the board.

We’ll talk about that in a Technically Speaking article – but most important for today’s Litepaper is a Stocktwits exclusive interview with the CEO of VanEck ETFs, Jan Van Eck – that’s right.

Make sure you check out what he has to say about their Bitcoin ETF application and the future of crypto.

But before we do that, here’s how the market looked at the end of the trading day:

| Cardano (ADA) |

$0.50

|

0.01% |

| Binance Coin (BNB) |

$294.90

|

0.09% |

| Bitcoin (BTC) | $22,427 | 2.77% |

| Dogecoin (DOGE) |

$0.064

|

0.00% |

| Ethereum (ETH) |

$1,724

|

-2.34% |

| Polkadot (DOT) | $7.74 | 0.52% |

| Solana (SOL) |

$37.68

|

7.65% |

| XRP (XRP) |

$0.36

|

0.45% |

| Altcoin Market Cap |

$604 Billion

|

-0.72% |

| Total Market Cap |

$1.03 Trillion

|

0.66% |

The Daily Rip and Litepaper had a fantastic opportunity to sit down with the CEO of one of the biggest names in ETFs: Jan van Eck. With the upcoming Merge for Ethereum ($ETH.X), Cardano’s ($ADA.X) Vasil hard fork, and the myriad of other events in the crypto space, there hasn’t been a lot of focus on the upcoming SEC decision over the fate of VanEck’s third spot Bitcoin ETF application.

The SEC has consistently rejected every spot ETF application. Why is that? And what is Bitcoin/crypto’s role in an overall investment portfolio anyway? We get into these questions and more in today’s exclusive chat with one of the biggest names on Wall Street.

Can you give us a brief intro on who you are and what VanEck is for those who are unfamiliar?

VanEck was founded in 1955, and our approach to investing is what I call ‘macro.’ It’s what international investors are very used to, which is looking at what’s happening worldwide. History as it reminds us that the world is radically changing all the time. As money managers, we try to offer funds that take advantage of the changes in the markets.

My father started the firm and is best known for creating the first gold fund in the United States in 1968, which led to our breakthrough. At the time, gold was pegged to around $35 an ounce and had been pegged against the dollar, not for just a couple of months but the entirety of US history—almost 200 years.

He took his fund and almost all the assets and bought gold mining shares, thinking that that would change. And it did a couple of years later. So I think that’s the kind of perspective we bring to the market.

Coming to Bitcoin in 2017, we had to determine: is Bitcoin ($BTC.X) going to be a real competitor to gold or not? We determined that it was. There was not much to read on Bitcoin back then unless you read the whitepaper or listened to some podcasts, but that was our conclusion. Since then, we’ve been saying that it should be considered a part of people’s portfolios.

Speaking of Bitcoin, let’s get right into that discussion. What role do you see Bitcoin playing in a portfolio?

Bitcoin ($BTC.X) is like a gold competitor—gold has had some soft competitors over time, like silver, platinum, and other precious metals. They are more monetary assets. What makes them different from oil is that oil is linked to the real economy. Copper is connected to the real economy. Gold is priced against central bank activity, and I think Bitcoin is like that, too.

We are in an era of Fed tightening, so stores of value are not going to do well. And you need to allocate to stores of value with that in mind – that’s Bitcoin and gold.

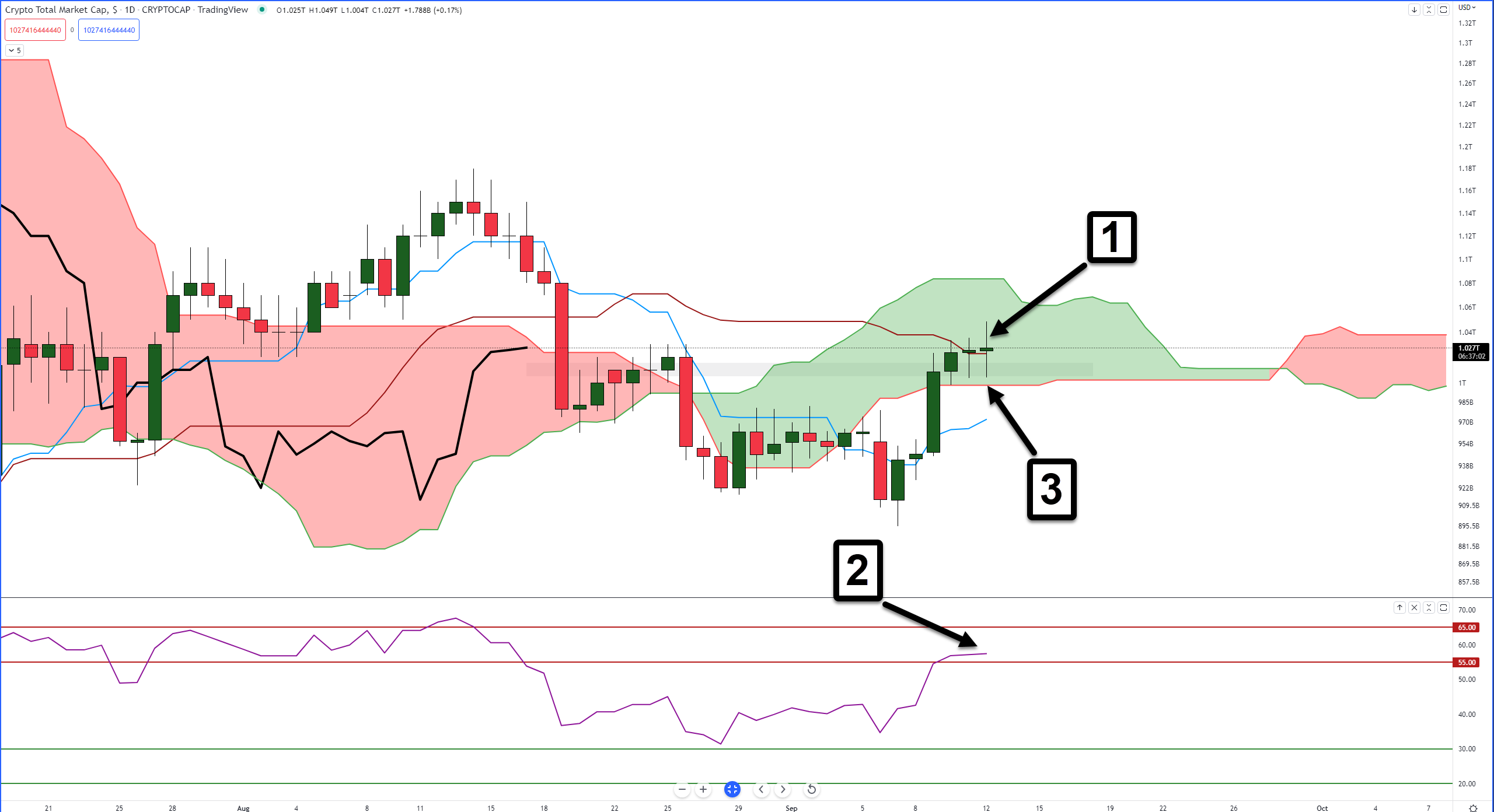

Whew. The crypto market survived the weekend. The Sunday-Slaughter, Red-Sunday, Sunday-Selloff, whatever you want to call it, didn’t happen this weekend. But that doesn’t mean it’s all sunshine and rainbows, either. Why? Because now the market is inside the Cloud.

Pro-tip: Read our introduction to the Ichimoku Kinko Hyo system here.

This is it. The Cloud. The place you don’t want to be.

Oh, sure, that all-you-can-eat buffet sounds great, right? Even though you get sick after eating there, you keep going. You’re not sure if it was the mushy, no-longer-crispy-chicken or the mac and cheese that’s been sitting out for three days, but you know you gambled and lost.

That is exactly what the Cloud is in the Ichimoku system. Things look tempting, but you get stung in the end. The Cloud is a place of regret, bad decisions, bad choices, and overall misery. It’s the place where trading accounts go to die.

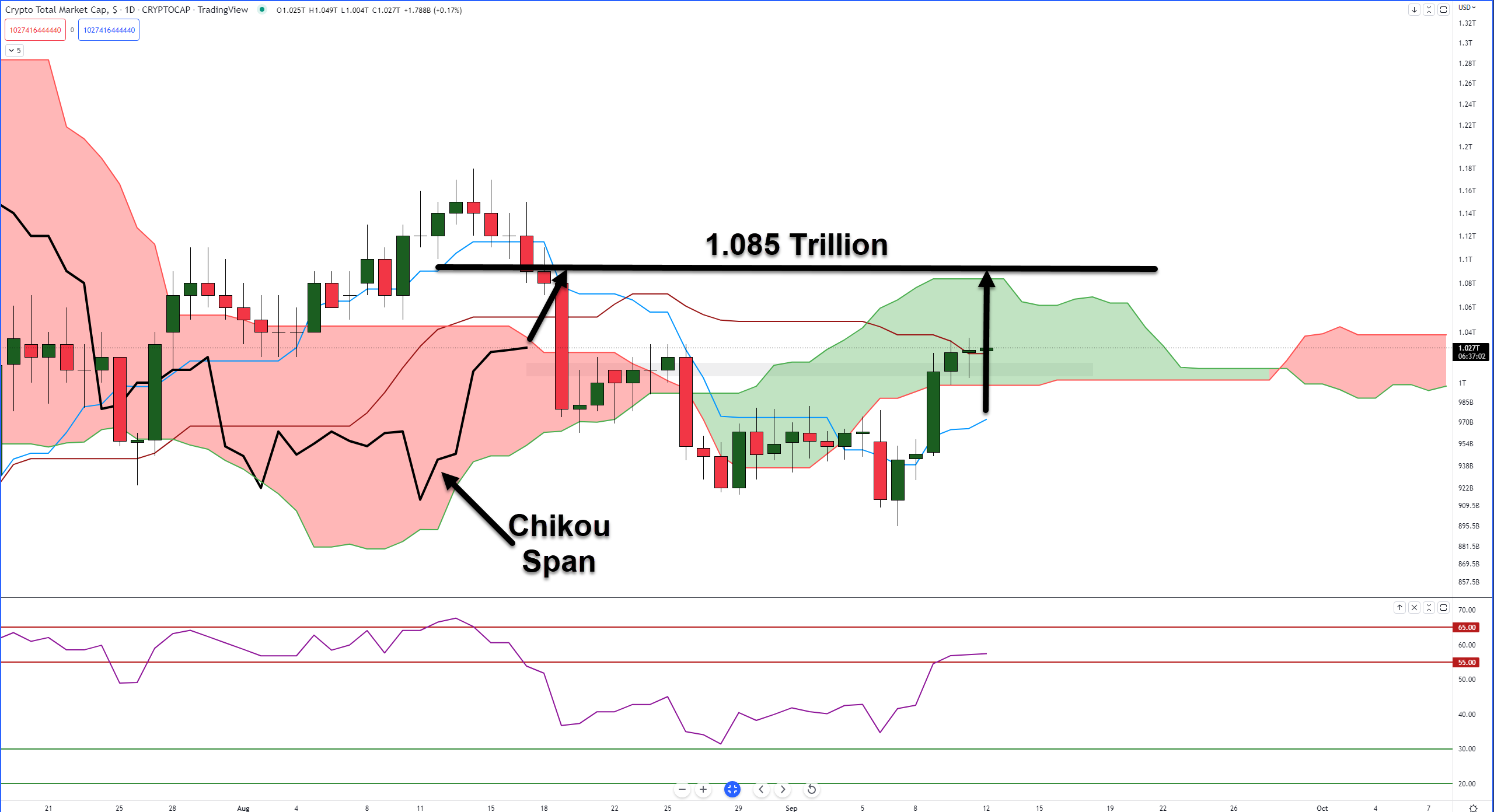

So, while the Total Market Cap has closed above the strongest resistance level in the Ichimoku Kinko Hyo system, Senkou Span B (#3), and it closed above the Kijun-Sen (#1), it’s still smack dab in the middle of that green Cloud of bad stuffs.

Now, that’s not to say something positive can’t come out of where the Total Market Cap chart is at – this is something that happens before a clear trade direction occurs. The RSI (#2) didn’t get rejected at 55 but has flattened out – so it’s hard to read the market here.

If we refer back to last Friday’s Litepaper, you’ll note that in order for there to be a very strong chance of a new bullish breakout, two things have to occur:

- The daily close needs to be above the Cloud.

- The Chikou Span needs to be above the bodies of the candlesticks.

By tomorrow, that would mean the Total Market Cap needs to close at or above $1.09 Trillion. Or $1.08 Trillion on Wednesday.

It’s going to be one hell of a crazy next couple of weeks, especially with the Ethereum ($ETH.X) Merge in a couple of days and Cardano’s ($ADA.X) Vasil hard for shortly after.

Bullets

Bullets From The Day:

😤 The White House released a report on the effects of Bitcoin ($BTC.X) mining and Proof-of-Work in general and suggested recommendations. Basically, Proo-of-Work is described as, but not quite like, the Chernobyl disaster. The solution is to regulate it to death. But Proof-of-Stake is fine. Read the full 46-page report here

🤔 Ethereum’s Merge ($ETH.X) is just a couple of days away. The change from Proof-of-Work to Proof-of-Stake is already being touted as a major upgrade in efficiency and scale. But does it make it more vulnerable to attack? There is some concern that security is at risk with the shift to PoS. Cointelegraph has the full story

🤑 According to a filing with the SEC, MicroStrategy ($MSTR) is prepping for a sale of shares in the $500 million range for ‘general corporate purposes.’ This is interesting because Michael Saylor stepped down as CEO nearly two months ago to focus more on the firm’s Bitcoin acquisition strategy. So it makes sense there is speculation that more BTC will be picked by Saylor’s MicroStrategy. Read more from ZyCrypto

Links

Links That Don’t Suck:

⤴️ NFT mints on Solana have surged to an all-time high

😁 $BTC: Canada’s New Conservative Party Leader Pierre Poilievre Is a Bitcoiner

😲 This Is How Marathon Digital Performed in August

🤜 JPMorgan Continues Web3 Hiring Spree, Now Focusing on Payments

🤜 Algorand Foundation Discloses $35M Exposure in Hodlnaut

🤜 Scaling Solution Polygon Plans To Aggressively Expand by Hiring 200 People in Coming Months: Report