There’s whipsaws and then there’s what’s happening right now. 🟩

The market is still trying to figure out what’s going on after Coinbase’s glitch and it’s still not fixed.

We’re going to look at that in today’s Litepaper, along with a short Technically Speaking on BTC and ETH, and a new spin on crpyto news: News In 3 Sentences.

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thelitepaper.stocktwits.com

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $60,486 | 6.02% |

| Ethereum (ETH) | $3,320 | 2.38% |

| Total Market Cap | $2.17 Trillion | 4.16% |

| Altcoin Market Cap | $983 Billion | 2.03% |

In case you missed it, this is what happened today. 🤢

It started like this:

and ended like this:

Because of this:

We are aware that some users may see a zero balance across their Coinbase accounts & may experience errors in buying or selling. Our team is investigating this & will provide an update shortly. Your assets are safe.

You can track this incident at https://t.co/a3pl4WiDhZ— Coinbase Support (@CoinbaseSupport) February 28, 2024

In roughly 30 minutes, 160 billion in market cap was lost. Rumors are flying that the hamster wheels powering $COIN‘s operations have all broken down.

A fake internal audit brought to light that instead of using brass wheels, some noob decided to save a few bucks and bought a semi truck’s load of made-in-China wheels. Upon further discovery, the wheels were not wheels but replacement gears for the 1990’s hit board game Mouse Trap.

In a nutshell, I was excited about the rally, and then the market equivalent of someone randomly kicking you in the nuts happened.

At the time of publishing, a few updates from their support page occurred. 🙁

Let’s be honest here, Coinbase’s problems are not the reason prices tanked after the rally, but it was a catalyst. From a technical analysis perspective, a small sneeze would cause some retracement. 🤧

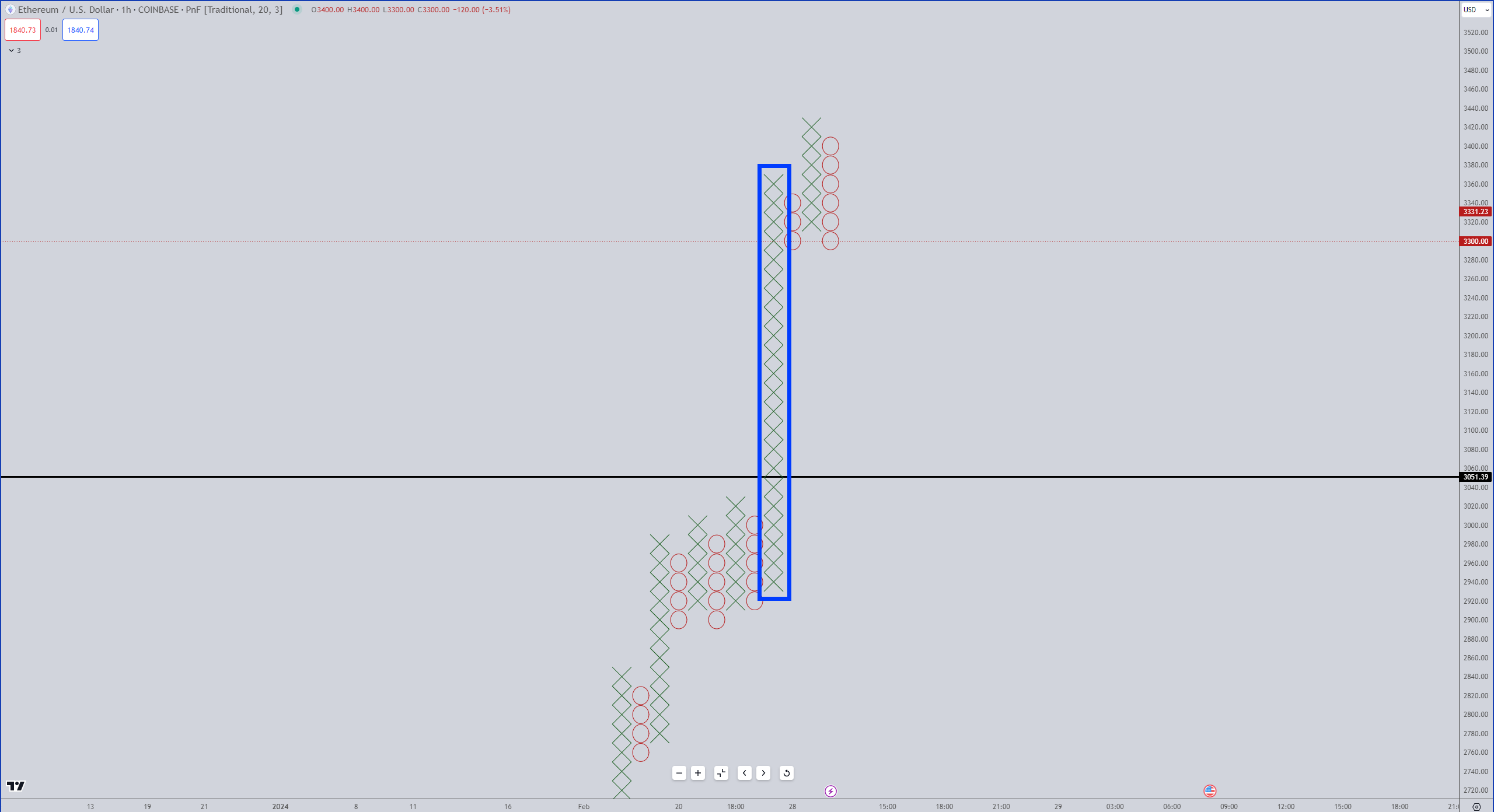

The chart above is a Point & Figure chart. You don’t need to know anything about it except for that hugenormous column of green X’s.

If you really want to learn about it, I recommend you watch this video here.

That massive column is called a Spike Pattern in Point & Figure – it’s the definition of exuberance and what you’d consider ‘overbought’. 🤯

The same Spike Pattern we just saw on Bitcoin’s chart is on Ethereum’s chart:

How bad could the retracement get? No idea. I know that a common retracement from a Spike Pattern is 50%. For Bitcoin, that’s a return to $57,500. For Ethereum, that’s a return to $3,150.

But let’s be honest here – the initial moves at the beginning of a new crypto expansion phase can be insane – so while the technical retracement is commonly 50%, crypto’s bull runs are anything but common. 🧠

Great Zeus’s Beard That’s A Lot: BTC ETF trading volume spiked over $7.5 billion, more than double its previous record. 😱 WatcherGuru has more

BlackRock Turns Bitcoin ETFs into Its Own Personal Money Printer: BlackRock’s ($BLK) massive $520 million infusion into $BTC ETFs, combined with Europe’s unrelenting buying spree and a nifty GBP arbitrage opportunity on $COIN, propelled Bitcoin past the $60,000 mark despite expectations of a pause. Short-sellers everywhere are now questioning their life decisions. 🚀 Read more from TrustNodes

JPMorgan’s Crypto Forecast Expects Sky High with a Chance of Moon: $JPM has flipped the script, now singing praises of Bitcoin and the broader crypto market, predicting sustained and enhanced prices. The bank’s newfound optimism is rooted in the anticipation of Bitcoin’s halving, $ETH‘s network upgrades, and the potential SEC nod for Ethereum ETFs, suggesting a bullish horizon dictated by retail investors’ resurgence and institutional net buys. 📈 From Cryptonemist

Artificial General Intelligence Coming In 2025. Skynet, Cyclons, they’re all coming to end humanity much sooner than we thought: Ben Goertzel, SingularityNET’s ($AGIX) visionary, is on the brink of unveiling a “baby AGI” prototype by early 2025, leveraging open source and decentralized principles to ensure this groundbreaking AI benefits humanity without falling under corporate or governmental control. With the upcoming Hyperon Alpha release, Goertzel’s approach promises a collaborative ecosystem where even a “12-year-old genius from Tajikistan” could contribute, embodying a fusion of innovation and inclusivity. 🤖 Cointelegraph has more

GALA’s Price Explosion: $GALA‘s price soared 27% following the launch of GalaSwap, a decentralized exchange on the new GalaChain network, marking a significant milestone with rewards for traders and referral incentives. This surge to a 10-month high reflects the broader crypto market’s recovery and a renewed interest in gaming tokens. Read more from Decrypt

Telegram Turns the Tables: Channel Owners to Cash in on Ads: Telegram has unveiled a revenue-sharing model, promising to share ad revenue with its channel creators. Pavel Durov aims to monetize the platform’s trillion monthly views more effectively starting this March. With the surge in $TON‘s token value, Telegram’s strategy could redefine digital content monetization, making it a win-win for creators and the platform. 💰 From CryptoGlobe

Trading or Trolling? The Truth Behind Justin Sun’s HTX Usage: Justin Sun, $TRX‘s founder, took to social media to silence skeptics of his HTX exchange usage by flaunting holdings worth over $1.6 billion in Bitcoin. Sun’s revelation has stirred the pot, prompting debates on the authenticity of his claims and the implications for HTX’s user base as the community speculates whether the trading volume is real. 🤑 Bitcoinist has more

Links

Links That Don’t Suck:

🐶 Unofficial GameStop memecoin’s $4M token presale draws investor controversy

👍 Ethereum insider promises ‘results soon’ for lawsuit against ETH founders

👮♂️ SBF is target for assault and extortion in prison claims fellow inmate

😱 Bitcoin ETFs surpass 50% of gold ETFs’ size as price tops $63,000

Say Hello

💻 Questions? Comments? Email Jon at jmorgan@stocktwits.com 💻