It happened. The total altcoin market cap returned to $1 trillion! 🟩

And the total market cap recaptured $2.25 trillion – just a hell of an awesome time for crypto people everywhere.

In today’s Litepaper, we’ll look at the significance of February’s close, what March usually looks like for Bitcoin, a bullish and bearish look at what to expect, and crypto news in three sentences.

P.S. Over the next month, we’ll be transitioning our newsletter platform to Beehiiv. To help ensure our emails keep making it to your inbox, please whitelist newsletter@thelitepaper.stocktwits.com

Here’s how the market looked at the end of the trading day:

| Bitcoin (BTC) | $62,437 | 1.99% |

| Ethereum (ETH) | $3,430 | 2.58% |

| Total Market Cap | $2.25 Trillion | 2.26% |

| Altcoin Market Cap | $1.02 Trillion | 2.88% |

Crypto

February Was Amazing

Historically, $BTC usually closes in the green in February. 2024’s Feb close brings the score to eleven bullish closes vs. three bearish closes since 2011. 👍

However, despite the high number of bullish closes for February, its average performance is very ‘meh.’ But not this year.

February’s close also put Bitcoin’s monthly winning streak at six in a row – tied for the longest stretch of monthly consecutive green months, the other being October 2020 – March 2021.

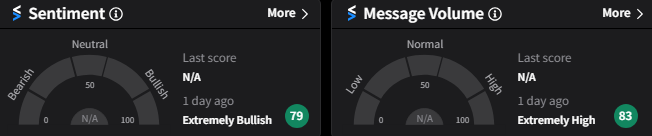

Makes you think whether a temporary top will come in or not – especially given the start of a new quarter and the crazy bullish Stocktwits Sentiment Data for Bitcoin:

We’ll discuss March more in the following article. Regardless, February 2024 will go down in the books as an amazing month. 👀

Here are some interesting stats on how Bitcoin performed historically in March. 📚

- Bitcoin closed March in the green four times versus eight times in the red.

- In the green months, Bitcoin showed off with an average percentage gain of +48.91%.

- On the downside, the average percentage loss during the red months was -15.62%.

This disparity between Bitcoin’s performance in March by average percentage gain/loss might suggest that when Bitcoin rallies in March, it goes all out. Conversely, when it falls, it doesn’t quite plunge into the abyss.

It’s a bit like March weather – one day, you’re basking in the early spring sun; the next, you wonder if winter ever really left. 🥶

For the eagle-eyed investor, these historical trends can be intriguing. While past performance is no guarantee of future results (as any financial advisor worth their salt will tell you), it’s food for thought.

Either way, Bitcoin in March is as unpredictable as a coin toss – which is fitting. 🪙

Spend any time on the Stocktwits Bitcoin stream; you’ll see many people screaming bull and others screaming bear. 🐻

There are strong cases for both, and I want to go over them, starting with the bearish case because it requires a ton more explanation than the bullish case.

A Damp Before The Pamp – The Bearish Case

This is where your tinfoil hat should be applied because this shit gets weird. I’m talking about time cycles.

W.D. Gann’s methods are some of the most crazy things you’ll ever learn. If you ever delve into Gann’s style of analysis, it will be the closest thing to being in an Indiana Jones story you’ll ever get. 🪖

Gann believed that the factor of time was why markets moved – not price, not the news, but time. He focused on price, too, but to him time was the most important. Gann focused on several time cycles, and when a good amount of those cycles ended in a cluster simultaneously, that was Gann’s way of saying pay the F attention to what happens around that period.

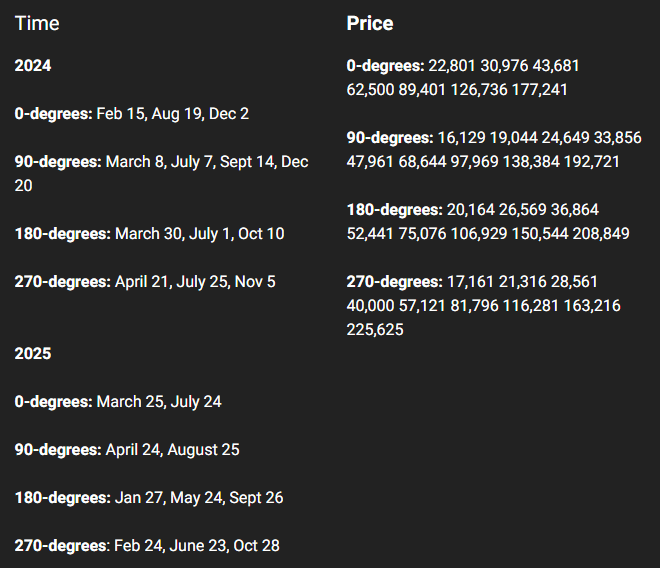

Here are some time cycle reasons for the bearish case and the respective numbers for the chart above:

- 180-day cycle: This is Gann’s second most important cycle, he consistently warned (and showed) that if an instrument is trending strongly in one direction over a 180-day (180 to 192 days to be specific) period, to be on alert for a violent pull back of broader trend change.

- 49-day Death Zone: Gann said that an instrument has a very high probability of retracing (pullback/throwback) if its been trending strongly over seven weeks (49 – 52 days to be specific).

- Six consecutive months higher is the longest Bitcoin has ever moved.

- As we read at the beginning of today’s Litepaper, March has a high probability of being a down month.

- 26 is an important number in Japanese Ichimoku Kinko Hyo analysis.

And as long as we’re talking about Gann, the following dates and price levels are from his Square of 9, which was one of Gann’s forecasting tools to identify important dates and price ranges in the future. 🔮

You’ll notice one of those dates is coming up soon and is inside the time cycles we just looked at:

That sums up the bearish case, now let’s look at the bullish case – which is much easier.

Continuation – The Bullish Case

This is crypto. Sometimes it seems like fundamentals and technicals don’t matter. It’s like Warren Buffet once said, “The market can remain irrational longer than you can remain solvent.”

And depending on how long you’ve been involved with crypto, you’ve probably seen or at least heard of some crazy ass parabolic moves that this market has.

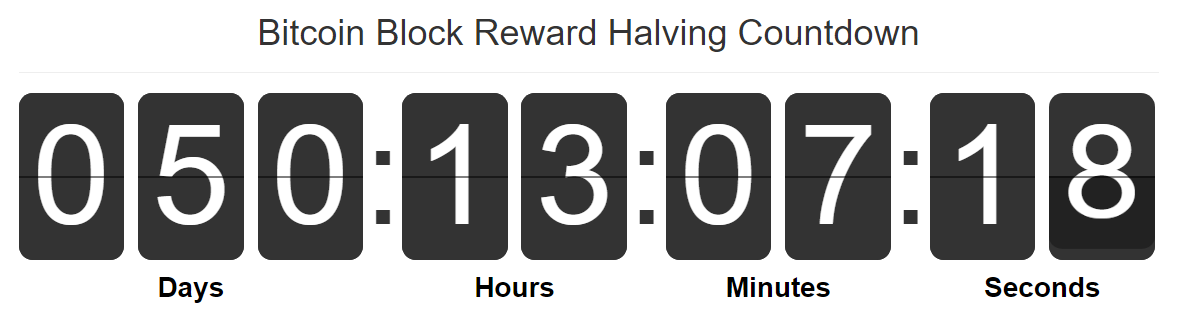

Bitcoin’s halving is right around the corner. Februaries close nearly pulled off the highest monthly close ever, BlackRock has $10 billion in BTC and keeps buying, Wells Fargo and Bank of America are entering, Vanguard fired their big boss probs because he said no to BTC… you could go on and on about the fundamental strength behind Bitcoin and why it will only keep mooning.

In a nutshell – who the hell knows? Don’t risk money you can’t afford to lose; if you don’t know how much to risk, talk to one of those fancy schmancy financial advisors. And I mean a real one, not the 28-year-old with a mullet walking around his pond on TikTok. 🤑

👀 Bitcoin ETFs Fly High Without Vanguard: The SEC’s nod to Bitcoin ETFs brings a seismic shift, yet giants like Vanguard ($VOO) stay on the bench, watching millions flow into these new funds. Despite Vanguard CEO Tim Buckley bowing out amid whispers of regret of not joining everyone else at the BTC ETF party, considering most of Vanguard AUM grew under Buckley, the no BTC ETF probably isn’t why. Probably. Maybe. From DailyCoin

🏦 Wells Fargo and BoA Embrace Crypto Craze: Speaking of Bitcoin ETF acceptance, Wells Fargo ($WFC) and Bank of America ($BAC) take the crypto plunge, offering Bitcoin ETFs to their daring clients. They join a financial frenzy alongside Schwab and Robinhood, contrasting Vanguard’s skeptical stance. Hey, maybe Wells Fargo will open crypto accounts for people who never asked them to? More from Cryptopolitan

👾 From Playtime to Guild Wars: ‘Pixels’ is set to revolutionize crypto gaming by introducing guilds, transforming resource generation and gameplay. This strategic shift aims to foster a competitive yet cooperative environment as guilds vie for control in a newly dynamic economy. Barwikowski’s vision for Pixels places guilds at the core of the game’s universe, promising a blend of competition, collaboration, and crypto innovation. Decrypt has more

💼 Suit Up: Grayscale Contemplates Courtroom Clash Over GBTC Options: Grayscale Investments is gearing up for a potential legal battle against the SEC following the rejection of options trading for its Grayscale Bitcoin Trust ($GBTC). Citing “unfair discrimination” against GBTC investors, Grayscale demands equal treatment to bitcoin futures ETFs, which have been allowed options trading. CEO Michael Sonnenshein advocates for GBTC options to bolster price discovery and investor hedging, emphasizing the need for parity in the options market for spot Bitcoin ETFs. From coinpaprika

🌕 To the Moon? Bitwise Predicts $200K Bitcoin in Post-Halving Boom: Bitwise’s CIO Matt Hougan projects Bitcoin’s price could soar to $200K post-halving, driven by a massive supply-demand imbalance highlighted by the explosive interest in US-listed spot Bitcoin ETFs. The purchasing power of these ETFs fuels this bullish outlook, dwarfing the production rate of new Bitcoins. Hougan’s optimism extends beyond Bitcoin, foreseeing a ripe market for spot Ethereum ETFs and a broader range of spot crypto ETFs, anticipating a future where Bitwise plays a pivotal role in a potentially $100 billion-plus market. More from CryptoGlobe

Links

Links That Don’t Suck:

📰 DWF Labs head Andrei Grachev reveals whether altcoin season has begun

🪙 BitMEX founder Arthur Hayes purchases altcoins from Binance again

🏆 Montana leads 7 States in legal challenge against SEC’s crypto crackdown

🎯 ‘Helldivers 2’ CEO says guns have hidden stats, so the ‘Meta’ is overblown

Say Hello

💻 Questions? Comments? Email Jon at jmorgan@stocktwits.com 💻