Optimism reigned supreme this week as investors continue to form their opinion about the economy’s future. ⏳

We saw macro data like the Purchasing Manager’s Index and New Home Sales plummet early in the week. But since Wednesday’s Fed Minutes, which were mainly in line with expectations, the market has been taking any new data in stride.

The CBO’s optimistic estimates for the U.S. economy also helped brighten the mood yesterday. ☀️

And today, April’s Personal Consumption Expenditures headline price index (PCE) showed inflation rose 6.3% YoY, slowing from the March reading.

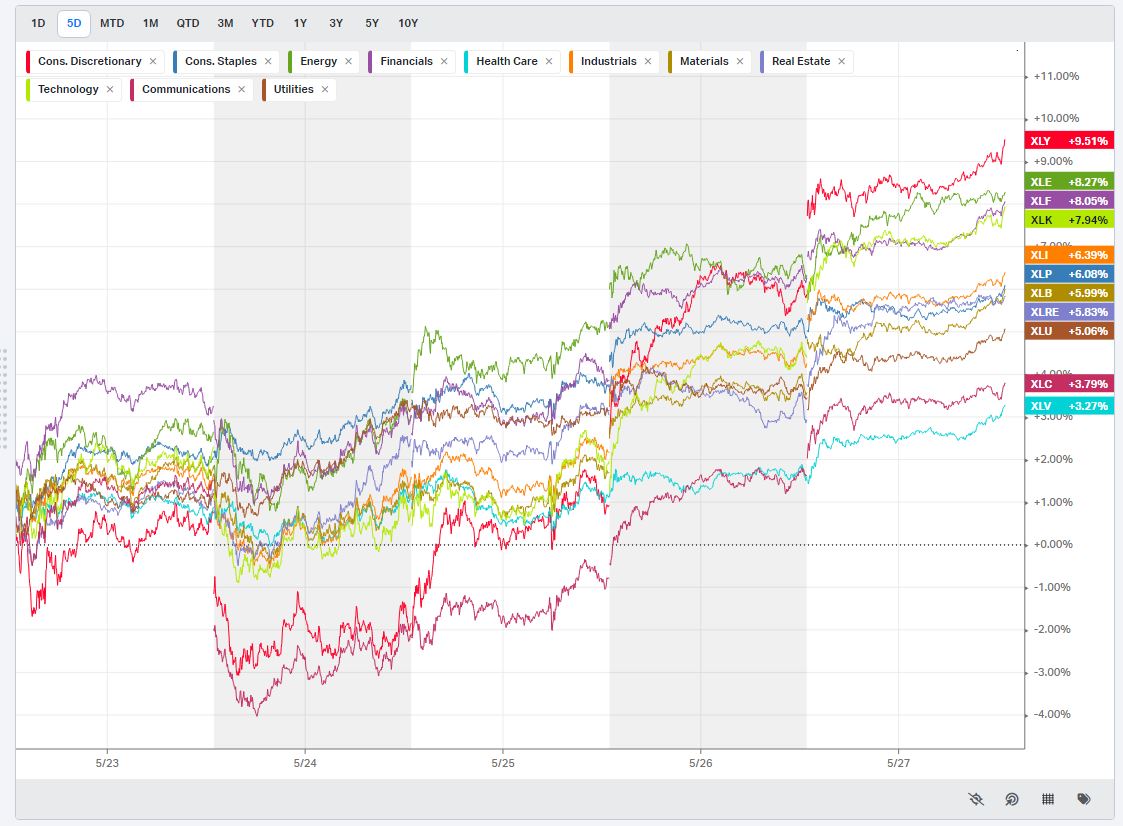

This week’s broad-based rally, led by offensive sectors like consumer discretionary, energy, financials, and technology, may be the start of investor sentiment turning more positive.

What’s clear is that stabilization in the bond market is helping risk appetite.

Remember, the market’s mess began when bonds started pricing in rapid inflation growth about a year ago. So the fact that Treasuries were able to notch their third week of gains in the face of elevated inflation readings suggests that maybe we’ve priced in enough pain for a while. 🤔

Lastly, one market that didn’t participate in this week’s rally was crypto. The space, which has recently traded along with stocks and other risk assets, bucked the trend and was down across the board. Ethereum is testing a significant long-term support level that many folks will have their eyes on this weekend. 👀

So is this a dead-cat bounce or the start of a summer rally for the market? Hop on to the streams and share your thoughts!