Advertisement|Remove ads.

Bitcoin’s Slide Triggers MSTR’s Biggest One-Day Drop In Over A Year – But These Three Crypto Stocks Took a Bigger Hit

- MSTR’s stock plunged 17.12% on Thursday, its largest one-day decline since May 2024.

- However, MSTR wasn’t the worst-performing stock of the day, with CleanSpark, MARA Holdings, and Hut 8 taking bigger hits.

- While most saw retail sentiment drop, MARA stood out among the few with retail sentiment improving over the past day, as per Stocktwits data.

Strategy (MSTR) shares plummeted on Thursday after weak earnings, combined with Bitcoin’s (BTC) slide below $65,000, weighing heavily on crypto-linked equities. While MSTR’s stock logged one of its steepest declines in months, several Bitcoin mining stocks fared even worse as the selloff intensified across the sector.

MSTR’s stock was on track to extend losses, slipping another 0.93% in after-hours trading after plunging 17.12% during the regular session — its largest one-day decline since May 2024. The stock was also among the top trending tickers on Stocktwits in overnight trade after reporting a 1,640% increase in operating loss during its fourth quarter (Q4) earnings. Revenue came in at $123 million, higher than the estimated $118 million by Wall Street.

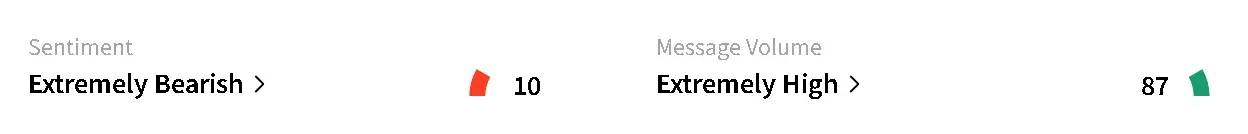

Retail sentiment around the Bitcoin proxy fell to its lowest level in a year within the ‘extremely bearish’ zone, while chatter jumped to ‘extremely high’ from ‘high’ levels over the past day. Platform data showed that message volumes increased by 312% in the last 24 hours.

One bullish user said they expect the stock to recover on Friday, pegging Thursday’s fall to the extreme volatility in the market.

Another suggested that MSTR needs to slash its overhead costs by firing everyone except the person who holds the keys to the Bitcoin vault.

Bitcoin Miners Take A Bigger Hit

Bitcoin miners like CleanSpark (CLSK), MARA Holdings (MARA), and Hut 8 (HUT) were the worst-performing crypto stocks on Thursday. CleanSpark’s shares fell 19.13%, while MARA’s stock dropped 18.72%.

CLSK’s stock led losses after hours as well, falling 8.62%. The only stock to take a bigger hit after market close was Cipher Mining (CIFR), down over 10% in overnight trade. The drop came after the company reported first quarter (Q1) earnings, which missed Wall Street expectations. Quarterly revenue came in at $181.2 million, marking an increase of 11.6% year-over-year, but below an analyst estimate of $187.73 million.

On Stocktwits, retail sentiment around CLSK’s stock fell to ‘extremely bearish’ from ‘bearish’ territory as chatter rose to ‘high’ from ‘normal’ levels over the past day.

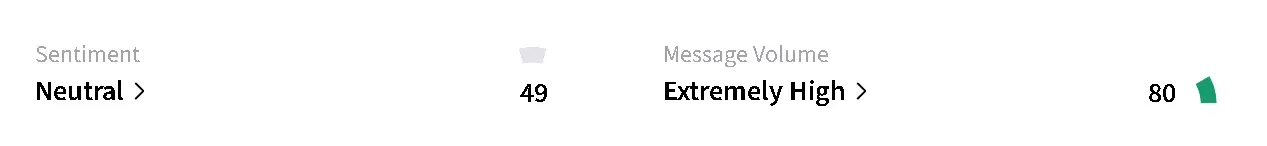

Meanwhile, MARA’s stock was down 1.78% in overnight trade, but saw retail sentiment on Stocktwits improving. It rose to ‘neutral’ from ‘bearish’ territory over the past day, while chatter climbed to ‘extremely high’ from ‘high’ levels.

HUT’s stock was close behind, sliding 17.89% on the day and edging 0.2% lower after hours. Retail sentiment around the company remained in ‘bearish’ territory over the past day, with chatter jumping to ‘high’ from ‘normal’ levels.

The overall cryptocurrency market plummeted 8.2% in the last 24 hours to $2.28 trillion. Bitcoin’s price took a hit of 9.7%, sliding to around $64,500 after touching an intra-day low of around $60,200, according to CoinGecko data, and sparking fears that a bigger drop may be on the horizon.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)