Advertisement|Remove ads.

Bank Of Japan’s Possible Rate Hike Has Retail Traders Accumulating Crypto Even As Bitcoin Dips Below $87,000

- Bitcoin dipped below $87,000 ahead of the Bank of Japan’s policy decision on Friday.

- Analysts have cited historical Bitcoin drawdowns following BOJ rate hikes.

- Only 11% of respondents said they were ‘taking profits’ ahead of the BOJ’s rate decision.

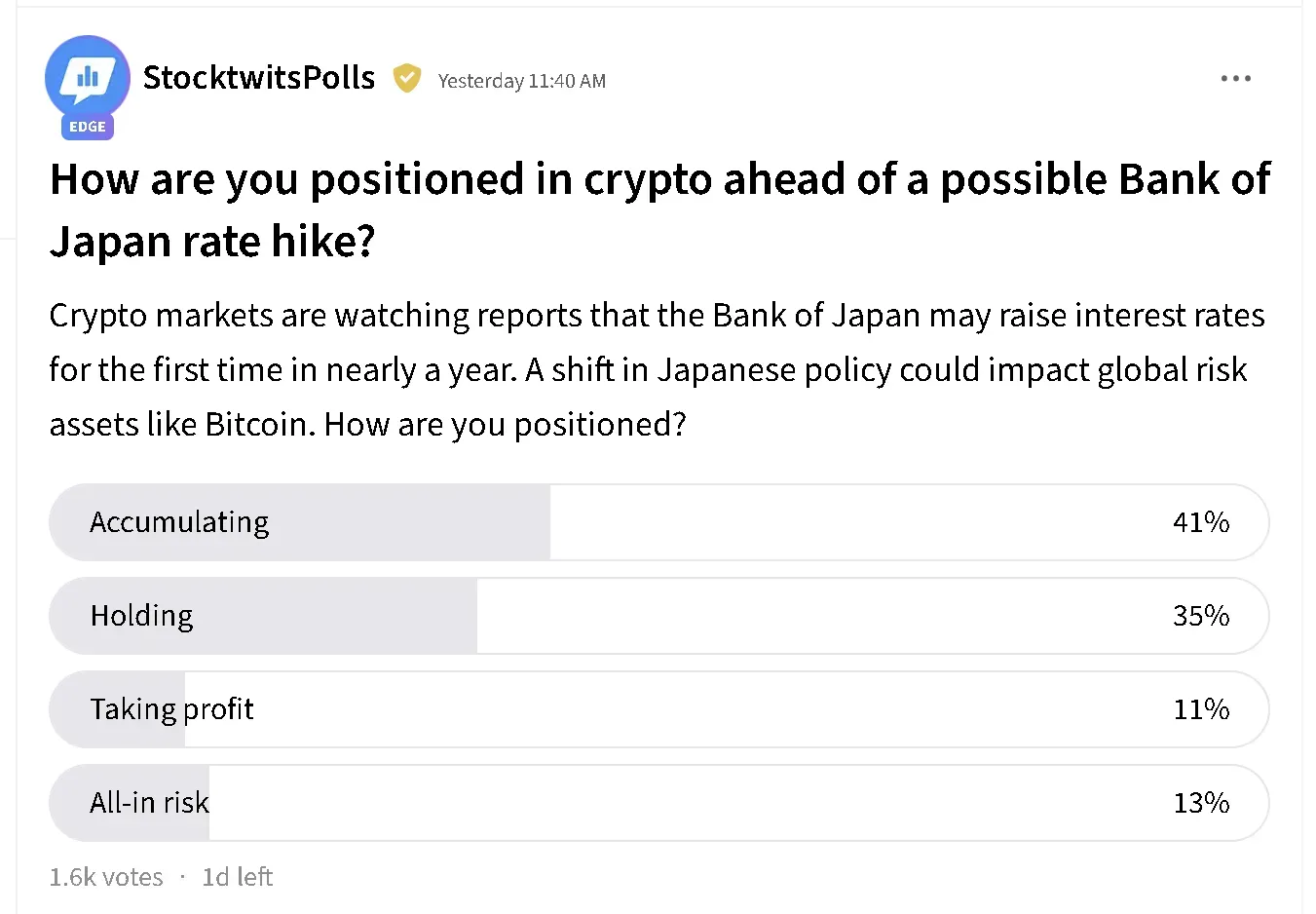

The prospect of the Bank of Japan lifting interest rates to the highest level in nearly three decades is pushing some retail traders to accumulate cryptocurrencies, according to a Stocktwits poll on Tuesday.

The data indicated that, at least for now, more respondents are leaning into exposure rather than de‑risking ahead of the central bank’s decision.

Retail Traders Lean Into Exposure

Despite those risks, the Stocktwits poll shows a plurality of retail traders remain constructive. About 41% of respondents said they are ‘accumulating’ crypto, the largest single group in the survey. Another 35% reported they are ‘Holding,’ signaling a wait-and-see approach.

At the more aggressive end, 13% described their stance as ‘all-in risk,’ while just 11% said they are ‘taking profit,’ making profit-taking the least popular response.

Bitcoin Slips Ahead Of BOJ Decision

Bitcoin’s price dipped below $87,000 on Tuesday night after a short-lived recovery, ahead of the Bank of Japan’s policy announcement. On Stocktwits, retail sentiment around the cryptocurrency trended in ‘extremely bearish’ territory over the past day, accompanied by ‘low’ levels of chatter. Ethereum (ETH) edged 0.4% lower in the last 24 hours. ETH's price traded at around $2,900, with retail sentiment falling to 'extremely bearish' from 'bullish' territory over the past day, as chatter dipped to 'low' from 'normal' levels.

Cardano (ADA) led losses among major tokens, down 0.8% in the last 24 hours. Meanwhile, Ripple’s native token (XRP) and Dogecoin (DOGE) led gains, up 1.8% and 1.3%, respectively in the last 24 hours.

According to a Nikkei report, the central bank is poised to raise rates for the first time in 11 months and could set borrowing costs at levels not seen since 1995. Multiple analysts have warned that a BOJ rate hike has historically coincided with sharp pullbacks in Bitcoin.

Read also: Kevin O’Leary Dumps All Crypto Except Bitcoin, Ethereum Ahead Of CLARITY Act ‘Turning Point’: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2185274983_jpg_0354a0740b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_x_0d62438a6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)