Advertisement|Remove ads.

Cathie Wood’s Ark Invest Bought BLSH’s Stock Dip Ahead Of Earnings – On Track To See Early Payoff

- Ark Invest’s buy came during a broader crypto selloff tied to Bitcoin’s drop toward $65,000.

- Bullish shares rose as much as 4.78% pre-market following its earnings report.

- CEO Tom Farley said the company is positioned to benefit from the current volatility and potential M&A opportunities.

Cathie Wood’s Ark Invest is on track to benefit from its massive buy of Bullish (BLSH) shares on Friday, after picking them on the cheap during the previous session as the shares fell more than 8% amid Bitcoin’s (BTC) crash to around $60,100.

BLSH’s stock rose as much as 4.78% in pre-market trade after the company reported earnings at par with Wall Street’s expectations. The company reported earnings of $0.19 on revenue of $98 million, meeting the consensus estimates, as per Koyfin data.

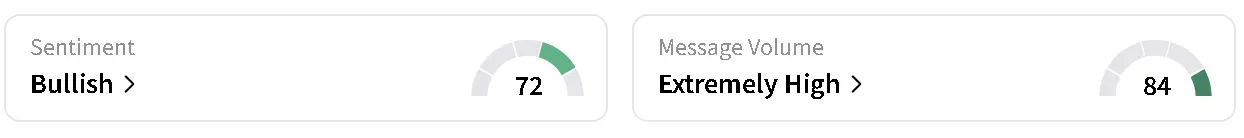

The uptick in BLSH's stock also came amid recovery in the broader market and Bitcoin's price shedding losses and rising to around $66,000. On Stocktwits, retail sentiment around the apex cryptocurrency remained in 'extremely bearish' territory amid 'extremely high' levels of chatter.

Ark Invest's Sole Crypto-Linked Buy On Thursday

Bullish shares were only crypto-linked equity that the company picked up on Thursday after chasing the dip in crypto stocks earlier in week and loading up Robinhood (HOOD), Bitmine Immersion Technologies (BMNR) and other crypto stocks.

The Peter Thield-backed crypto exchange may have been the only crypto company added by Ark Invest on Thursday, but the firm bought a sizable 716,030 shares across its ARK Innovation ETF (ARKK), ARK Fintech Innovation ETF (ARKF) and ARK Next Generation Internet ETF (ARKW).

What Is Retail Saying?

On Stocktwits, retail sentiment around BLSH’s stock moved higher within ‘bullish’ territory as chatter jumped to ‘extremely high’ from ‘high’ levels. Platform data showed a 61.5% increase in message volume over the last 24 hours.

One user said predicted that BLSH’s stock would rise based on an increase in trading volumes and range-bound movement.

Another noted that the company’s earning call was impressive.

Chairman and CEO Tom Farley said Bullish closed 2025 with “strong momentum,” pointing to record results. He said the next phase of digital asset growth would be driven by tokenization of real-world assets (RWAs) and broader institutional adoption of blockchain technology.

Farley added that Bullish is positioned to benefit from volatility and potentially pursue inorganic opportunities, stating the current market environment may create “promising opportunities to grow … organically as well as through M&A.”

BLSH’s stock is down over 73% since its debut in August last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)