Advertisement|Remove ads.

Crypto Slide Deepens: Bitcoin Risks Drop To $90K Range, Warns Analyst

- A one-year trade truce between the U.S. and China has done little to support Bitcoin prices, which saw a monthly decline in October for the first time since 2018.

- Spot BTC ETFs logged over $186.5 million in outflows on Monday, marking a fourth-straight day of outflows.

- Michael Saylor, the founder of Strategy, said he still believes Bitcoin would reach $150,000 by the end of the year.

A one-year trade truce between the U.S. and China has done little to support Bitcoin prices, which saw a monthly decline in October for the first time since 2018.

Spot BTC ETFs logged over $186.5 million in outflows on Monday, marking a fourth-straight day of outflows.

Michael Saylor, the founder of Strategy, said he still believes Bitcoin would reach $150,000 by the end of the year.

Bitcoin and other major cryptocurrencies declined again on Tuesday, marking a tepid start to the week amid investor concerns about a lack of near-term catalysts, with analysts issuing warnings that the correction could persist.

The apex cryptocurrency fell 2.6% to $104,451.50 at the time of writing, according to CoinMarketCap data, while Ethereum fell 5.3% to $3,507.42 and XRP slipped over 5% to $2.27. Among other tokens, BNB was down 6.6%, Solana was down 8.9%, and Dogecoin was down close to 4.5%.

What Is Driving Bitcoin Prices Lower?

“Risk appetite in crypto has cooled sharply since the Oct. 10 crash, which came just four days after Bitcoin hit fresh record highs, cruelly crushing bullish euphoria. Bitcoin has been left in [a] vacuum and needs fresh catalysts to regain momentum,” said Tony Sycamore, IG Markets analyst.

A one-year trade truce between the U.S. and China has done little to support Bitcoin prices, which saw a monthly decline in October for the first time since 2018. Even a 25-basis-point rate cut by the Federal Reserve has done little to persuade investors, with Fed Chair Jerome Powell warning that another rate cut in December is not a certainty.

“While Bitcoin remains below the $116/$117k resistance zone, it is vulnerable to a deeper pullback into the mid $90,000’s to complete the correction,” Sycamore warned.

Spot BTC ETFs logged over $186.5 million in outflows on Monday, marking a fourth-straight day of outflows. According to CoinGlass data, Bitcoin liquidations surged to $1.36 billion, forcing investors who were long on the cryptocurrency to exit their positions.

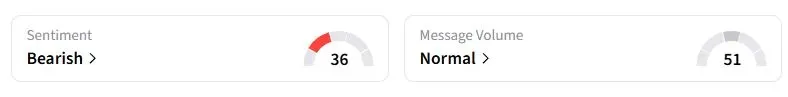

Retail sentiment on Stocktwits about Bitcoin was in the ‘bearish’ territory at the time of writing.

Strategy Chair Michael Saylor Remains Confident

Michael Saylor, whose firm Strategy pioneered the concept of cryptocurrency treasuries, said at Schwab Network's "Market Overtime" that he still believes Bitcoin would reach $150,000 by the end of the year. He also believed that the apex cryptocurrency would continue growing by about 29% a year for 21 years and dubbed it an elegant way to create a property network.

Also See: Morgan Stanley Chief Ted Pick Proclaims China As Top Draw For Asset Managers

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)