Advertisement|Remove ads.

Gold Moved First — Bitcoin May Be Next, Says Michael Van Poppe

- Michael van Poppe says gold’s recent strength may be reaching an inflection point.

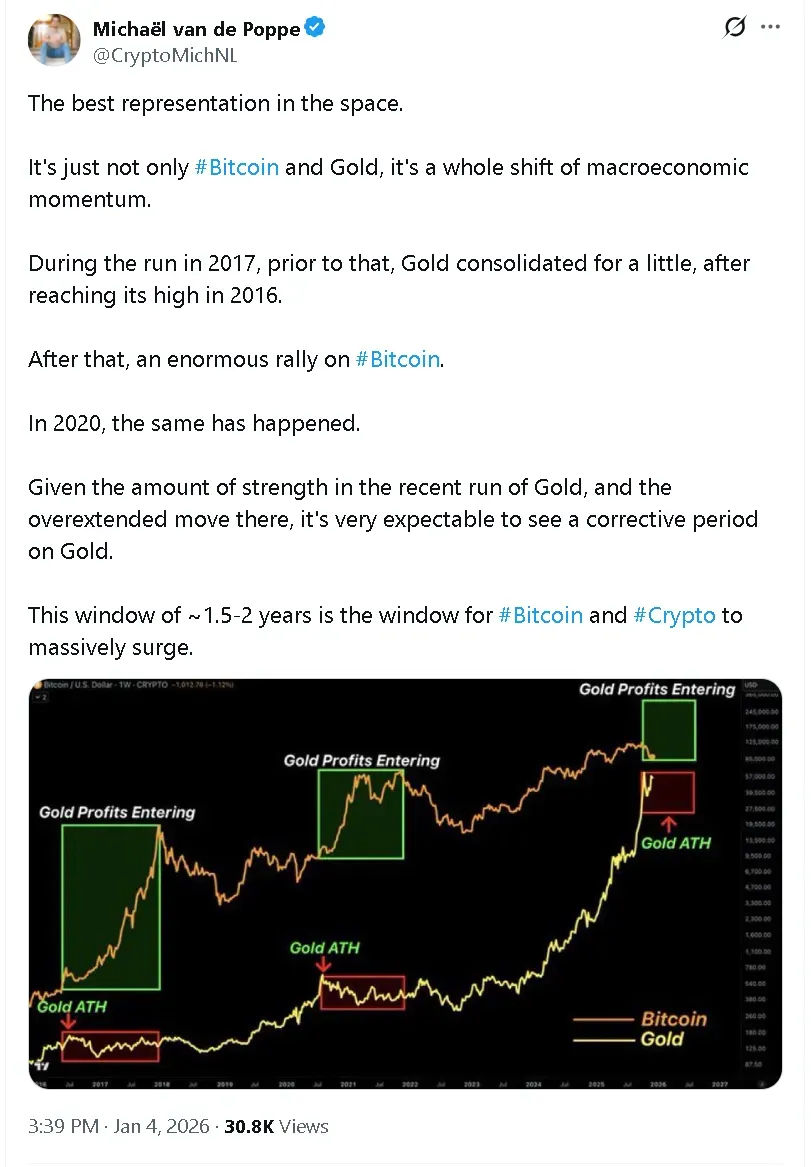

- He drew parallels to earlier cycles where gold consolidation preceded Bitcoin rallies.

- He stated the setup reflects broader macroeconomic momentum rather than asset-specific drivers.

MN Fund founder and chief investment officer Michael van Poppe said on Sunday that with gold appearing extended after its recent rally, a window may be opening for Bitcoin (BTC) and crypto outperform over the next one to two years.

“This window of 1.5–2 years is the window for Bitcoin and Crypto to massively surge,” he wrote in a post on X, adding that the move would be driven by macro momentum rather than any one single catalyst.

Bitcoin’s price rose 2% in the last 24 hours, holding above $93,000 in early morning trade. On Stocktwits, retail sentiment around the apex cryptocurrency rose to ‘extremely bullish’ from ‘bullish’ territory over the past day, while chatter remained at ‘normal’ levels.

Meanwhile, the SPDR Gold Shares ETF (GLD) also rose nearly 2% in pre-market trade. Retail sentiment around the fund on Stocktwits moved lower into ‘neutral’ territory from the ‘bullish’ zone, accompanied by ‘high’ levels of chatter.

Gold Rally May Be Losing Momentum

Van Poppe stated that the current setup reflects earlier market cycles in which periods of consolidation or correction in gold preceded strong advances in Bitcoin. He said the shift is part of a broader change in macroeconomic momentum.

The crypto analyst noted that gold’s sharp run higher in recent months has left it increasingly extended. He added that historical patterns suggest that gold enters a corrective or sideways phase after strong rallies, creating space for alternative assets like Bitcoin to outperform.

Bitcoin Cycles Echo Past Market Shifts

The CIO compared the market setup to previous market cycles, noting that gold consolidated after peaking in 2016 before Bitcoin surged during its 2017 bull run. A similar pattern emerged in 2020, when gold paused after its rally and Bitcoin began a strong advance.

“Given the amount of strength in the recent run of Gold, and the overextended move there, it’s very expectable to see a corrective period on Gold,” he wrote.

A One-to-Two Year Window For Crypto

Van Poppe said the current environment could set the stage for a sustained period of crypto strength lasting roughly 18 months to two years. He said the opportunity extends beyond Bitcoin to the wider cryptocurrency market.

In another post, van Poppe said the final hurdle for Bitcoin to clear is to cross the $100,000 mark. While he does not expect a “clear-chut, immediate breakout”, van Poppe said the year has started out bullish.

Read also: MARA Stock Rises On Signs It May Tap Bitcoin Sale To Fund AI Push

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Christopher_Giancarlo_OG_jpg_915015c289.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227884296_jpg_f4ab8e4dcf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_crypto_atm_OG_jpg_ab7e4567eb.webp)