Advertisement|Remove ads.

‘Solana Is Bitcoin 3.0’ – CIO Of Europe’s Oldest Crypto Fund Calls BTC ‘Unusable’ In Comparison To SOL

- Justin Bons urged investors to abandon Bitcoin in favor of Solana in a recent post on X.

- He criticized Bitcoin's scalability, governance, and programmatic limitations.

- Solana’s active validator count has fallen sharply, dropping from more than 2,500 in early 2023 to under 1,000 in 2025.

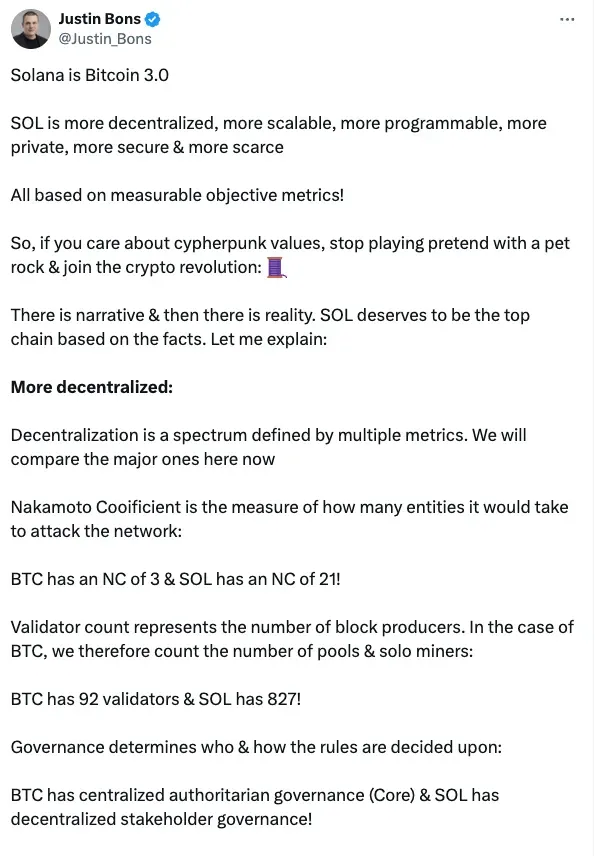

Cyber Capital's founder and chief investment officer, Justin Bons, called Solana (SOL) "Bitcoin 3.0” on Sunday.

Cyber Capital is Europe’s oldest cryptocurrency fund, founded in 2016. In a post on X, Bons compared Solana and Bitcoin (BTC), saying that “SOL is more decentralized, more scalable, more programmable, more private, more secure & more scarce.” He argued that his parameters depended on "measurable data" instead of "market narratives."

Nakamoto Coefficient

Bons used the measure of decentralization in blockchain networks, also known as the Nakamoto Coefficient, to illustrate that it is harder to coordinate attacks on Solana due to its higher coefficient.

He also looked at the number of validators and found that Solana has more active validators than Bitcoin when mining pools and solo miners are taken into account.

Solana’s price was trading at $132.43, down 0.34% over the last day. On Stocktwits, the retail sentiment around SOL remained in ‘bullish’ territory over the past day, with ‘low’ levels of chatter.

Meanwhile, Bitcoin’s price continued to trade below $90,000, down 0.6% in the last 24 hours. Retail sentiment around the apex cryptocurrency on Stocktwits trended in ‘bearish’ territory over the past day, amid ‘low’ levels of chatter.

Solana Validators

Solana's validators have decreased from about 2,560 to approximately 906 in the last two years, as per Solana Floor. A lower validator count could have an impact on decentralization and network security by reducing the number of independent operators and increasing stake concentration among top validators.

Bitcoin Is ‘Unusable For Any Significant Use Cases’

Besides the validator count, Bons compared the governance models, saying that Bitcoin's development process is more centralized around core contributors and that Solana's governance is based on stakeholders.

In terms of scalability, Bons highlighted Solana's higher transaction capacity and faster processing times when compared to Bitcoin. He explained that Bitcoin's limited throughput limits its ability to support large-scale transactions, while Solana allows high on-chain activity.

Bons said that Bitcoin doesn't support a Turing-complete virtual machine, which makes it hard for native decentralized finance apps to work. He compared this to Solana's smart contract environment, which lets more types of on-chain apps work. He also stated that Solana is harder to attack than Bitcoin.

“So, if you care about Bitcoin's original vision, cypherpunk values & the crypto ethos, abandon BTC & support SOL instead,” he concluded.

Read also: Tron Outperforms Bitcoin, Ethereum And Major Tokens, Defying Broader Crypto Market Weakness

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)