Advertisement|Remove ads.

The Biggest Risk To MSTR Isn't MSCI Delisting Or Bitcoin’s Price Crashing, Says Analyst

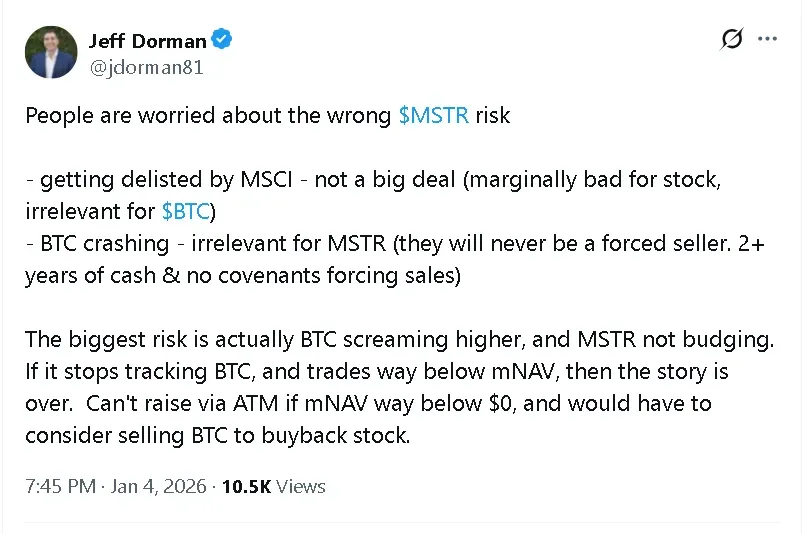

- Jeff Dorman, the chief investment officer at Arca, said in a post on X that the biggest threat to MSTR is if the stock decouples from Bitcoin’s price movements.

- According to him, even if Bitcoin’s price crashes and MSTR’s stock price goes down with it, the company has two years of cash runway to survive.

- However, the company could be forced to sell stock if Bitcoin’s price shoots up but MSTR’s stock price doesn’t rise with it.

Strategy (MSTR) edged 0.85% higher in after-hours trade on Sunday as Bitcoin (BTC) rose to touch $93,000 ahead of the company announcing its weekly Bitcoin purchase, or an addition to its newly created U.S. dollar reserve.

According to Jeff Dorman, chief investment officer at Arca, neither a potential removal from the MSCI index nor a sharp drop in Bitcoin’s price represents the real threat facing Strategy. In a post on X, the former Lehman, Merrill, and Citadel analyst said the more serious risk is a scenario in which Strategy’s share price fails to rise alongside Bitcoin.

On Stocktwits, MSTR’s stock was among the top trending tickers on the platform on Sunday night. Retail sentiment around the shares rose to ‘neutral’ from ‘bearish’ territory over the past day, accompanied by chatter at ‘normal’ levels. Meanwhile, retail sentiment around Bitcoin jumped to ‘extremely bullish’ to ‘bullish’ territory over the past day, notably flipping from the ‘bearish’ zone seen last week. Chatter remained at ‘normal’ levels.

Bitcoin Crashing Isn’t the Core Risk

Dorman pushed back on concerns that Strategy could face meaningful downside from a potential MSCI index removal. He said the risk of being dropped from MSCI is “marginally bad for stock” and “irrelevant for $BTC,” arguing it would have little impact on Strategy’s underlying business or its balance sheet. Investors are also watching MSTR’s stock for its potential inclusion in the S&P 500 this quarter.

Dorman added that Strategy would not be forced into selling its holdings even during periods of extreme volatility for Bitcoin. According to him, the company holds more than two years of cash runway and faces no covenants that would require Bitcoin sales under stress scenarios.

The Risk That Could Break the MSTR Story

Dorman identified the biggest concern for Strategy as a scenario where Bitcoin “screaming higher” fails to lift Strategy’s stock price. If MSTR were to decouple from Bitcoin and trade well below its market net asset value (mNAV), the company’s capital-raising model could come under strain.

In that case, issuing shares through at-the-market offerings would become difficult if the stock trades meaningfully below mNAV. In such a situation, Strategy may be forced to consider selling Bitcoin to repurchase stock, undermining the core premise of the trade.

Ahead of Monday’s announcement, Saylor posted “orange or green?” on X, teasing whether the company plans to buy more Bitcoin or add to its USD reserves. The newly created dollar reserve was established last month to support preferred stock dividend payments and service debt obligations.

The company currently has 672,497 Bitcoin in its treasury, valued at around $62 billion as per Bitcoin's current price, and its USD reserve stands at $2.19 billion.

Read also: MSTR, COIN, CLSK Gain As Crypto-Linked Stocks Rally After Bitcoin Breaks Above $93,000

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)