Advertisement|Remove ads.

Ethereum Bull Tom Lee Hints Precious Metal’s Rally Is Stealing Crypto’s Thunder

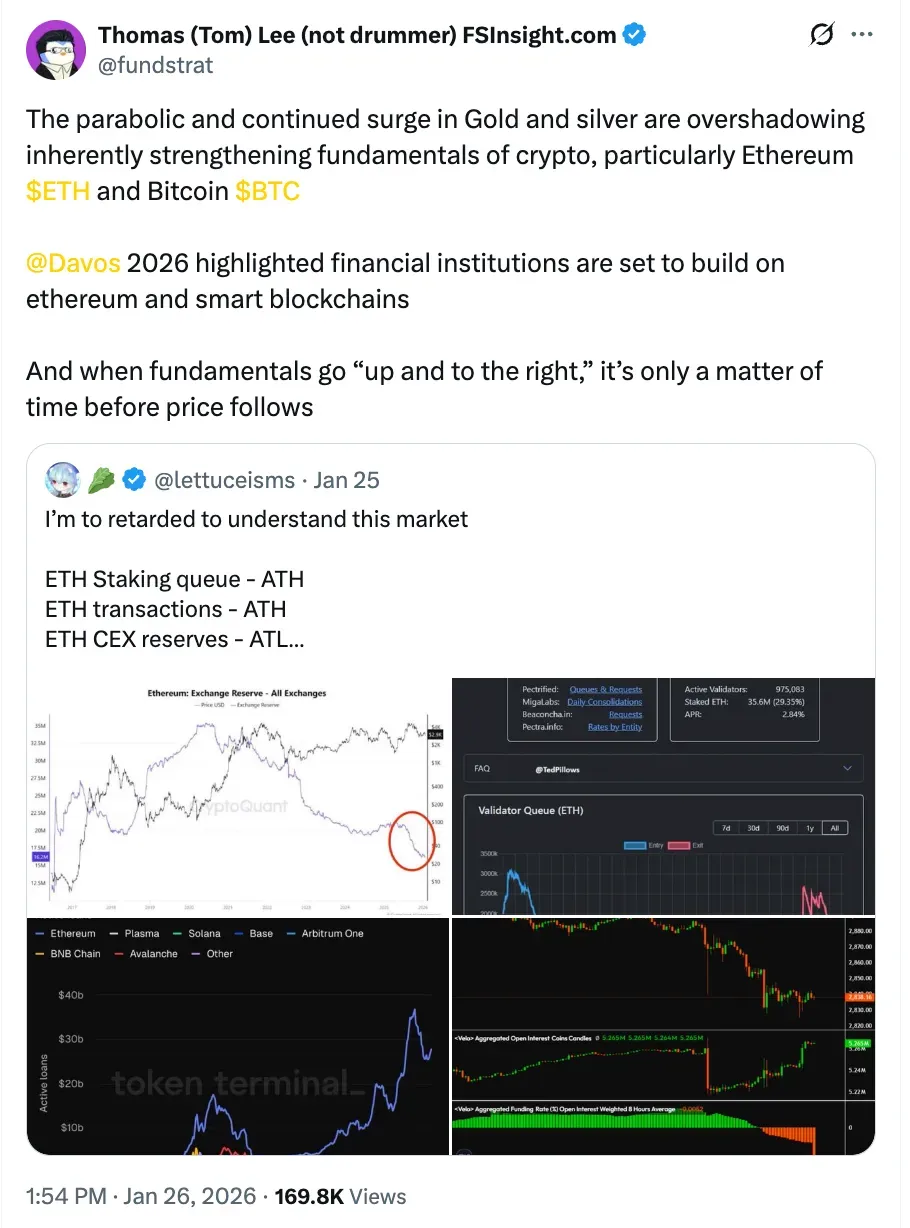

- Fundstrat’s Tom Lee said the “parabolic” move in gold and silver is drawing attention away from improving underlying fundamentals across crypto markets.

- He pointed out that Bitcoin and Ethereum are the key assets where structural strength continues to build despite being overshadowed by the precious metals rally.

- Tom Lee also cited the October 10 deleveraging event, which wiped out $19.16 billion from the market as the reason why price recovery has been slower.

Tom Lee, the head of research at Fundstrat, believes that the rise in gold and silver prices is diverting attention and capital away from improving the fundamentals of the crypto market, especially Bitcoin (BTC) and Ethereum (ETH), but he remains bullish on the crypto assets.

Lee wrote on X that the "parabolic" move in precious metals like gold and silver has taken attention away from what he called "inherently improving structural signals" in crypto. He said that Ethereum and Bitcoin are two assets with fundamentals "up and to the right."

According to Lee, the recent surge in gold and silver is taking money away from cryptocurrency due to mechanical allocation decisions driven by risk and leverage budgets, rather than investors rejecting digital assets. He also said that historically, price action tends to follow once attention and liquidity rotate back.

Crypto markets are experiencing a more severe liquidity squeeze because they have already deleveraged. Because of this, prices are not keeping pace with improving fundamentals such as improved financial conditions, institutional adoption, and increased network activity.

Lee, who has been bullish on Ethereum for a while, expanded on this view in a CNBC interview, saying that the slow price response in crypto today is due to aftershocks from a major de-leveraging event on October 10, when $19.16 billion was flushed out of the crypto market. Lee says that the episode hurt many exchanges and market-making firms, leaving the industry with less leverage and less speculative firepower.

“The industry is still limping from that shock,” Lee said, explaining that while fundamentals have improved, crypto no longer benefits from the same leverage-driven tailwinds that previously amplified rallies.

Bitcoin (BTC) was trading at $88,276.50, up 0.47%, while Ethereum (ETH) was trading at $2,927.56, up 0.91% over the last day. Both the assets have been in the negative alley over the past week. On Stocktwits, retail sentiment around Bitcoin improved from ‘extremely bearish’ to ‘bearish’ zone, but chatter dipped from ‘high’ to ‘normal’ over the past day.

On Stocktwits, retail sentiment around Ethereum remained in ‘extremely bearish’ territory, as chatter around it remained in ‘low’ levels over the past day.

The Davos Signal Is Bullish For Crypto Assets

Lee presented institutional momentum as unmistakably positive despite short-term price frustration. He cited talks at Davos 2026 as proof that traditional finance increasingly views capital markets and blockchain infrastructure as complementary ecosystems rather than antagonistic.

He added, “I think even Davos really amplified that Wall Street is now starting to view traditional finance and tokenization and blockchains as one business that's converging.”

He pointed out that senior leadership from international financial firms like UBS, Standard Chartered, and Euroclear now provides support, not just prominent individuals like BlackRock CEO Larry Fink. According to Lee, tokenization and blockchain-based financial rails are strategically validated as components of the future market infrastructure.

Read also: What Happens To Crypto If Quantum Computers Break Encryption? Coinbase Is Taking Early Steps To Address Threats

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1005541622_jpg_8079d8d434.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)