Advertisement|Remove ads.

Abercrombie & Fitch Stock Soars After Upbeat Q1 Results: Retail Turns More Bullish

Shares of lifestyle retailer Abercrombie & Fitch Co. (ANF) surged 28% in Wednesday’s premarket after the company reported better-than-expected first-quarter (Q1) earnings.

Abercrombie’s Q1 2025 (FY25) net sales increased 8% year-on-year (YoY) to $1.1 billion, beating the analyst consensus estimate of $1.05 billion, as per Finchat data.

The company's adjusted earnings per share (EPS) stood at $1.59, exceeding the consensus estimate of $1.36.

This performance was bolstered by strong demand for Abercrombie’s Hollister brand, which saw a 23% rise in comparable sales, driven by popular items like vintage-style tees and denim.

The Abercrombie brand experienced a 10% decline in comparable sales, attributed to ongoing brand repositioning efforts.

The Americas segment achieved a 9% increase in net sales, totaling $636.1 million. Internationally, the Asia-Pacific region saw an 11% rise in sales, while the Europe, Middle East, and Africa (EMEA) region experienced a 15% decline.

The company's gross margin expanded by 570 basis points to 61%, primarily due to reduced freight costs and higher average unit retail prices. The operating margin declined 340 basis points to 9.3%.

Abercrombie ended the quarter with cash and cash equivalents of $511 million.

For FY25, the company projects net sales growth of 3% to 6%, an operating margin between 12.5% and 13.5%, and net income per diluted share ranging from $9.50 to $10.50.

For Q2, the company anticipates net sales growth of 3% to 5%, and net income per diluted share ranging from $2.10 to $2.30.

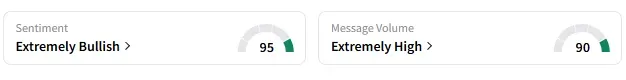

On Stocktwits, retail sentiment around Abercrombie & Fitch turned to ‘extremely bullish’ from ‘bullish’ the previous day.

A Stocktwits user lauded the earnings.

Another user highlighted that the company’s stores attract younger crowds.

Abercrombie & Fitch stock has shed over 48% in 2025 and over 49% in the last 12 months.

Also See: Box Stock Surges Post Strong Q1, Wall Street Lifts Price Target: Retail’s Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226079120_jpg_10ed2924af.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239867148_jpg_8df22810c1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347123_jpg_b7a8c29717.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)