Advertisement|Remove ads.

Allied Blenders and Distillers: Retail Buzz Surges, SEBI RA Sees Short-term Upside To ₹550

Allied Blenders and Distillers is currently trying to break past a key resistance zone.

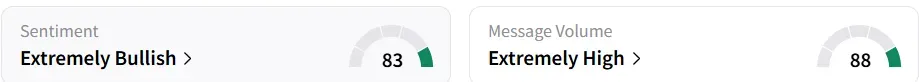

Meanwhile, the retail sentiment on Stocktwits shifted to ‘extremely bullish’ from ‘neutral’ a day earlier amid ‘extremely high’ message volumes.

The stock is trading just below the ₹500 - ₹510 resistance zone, which marks a recent swing high, with multiple candles with long upper wicks. These signals indicate either profit booking or temporary exhaustion, noted SEBI-registered analyst Vijay Kumar Gupta.

A strong breakout and close above ₹510 could unlock further momentum, potentially targeting ₹530 and ₹550 in the short term, Gupta said.

Technically, the stock remains in a bullish structure, with higher highs and higher lows firmly in place.

After a sharp uptrend, price action has entered a healthy retracement phase, which may signal accumulation just below resistance. This type of consolidation often precedes a breakout if supported by volume, the analyst said.

Support for the stock lies in the ₹455 - ₹465 zone, which aligns with a recent sideways range and offers a good entry opportunity, Kumar said.

A stronger demand area exists between ₹410 - ₹435, which was also the stock’s earlier consolidation and breakout zone.

For longer-term investors, ₹320 - ₹350 remains a critical bullish order block cluster and serves as an ideal re-entry level in case of deeper corrections.

Gupta recommends a stop-loss below ₹455 for fresh entries, and below ₹435 for positional traders.

The stock closed 2.3% higher at ₹487, having gained 12.4% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)