Advertisement|Remove ads.

Altus Power Stock Edges Lower On Q4 Miss, But Retail Remains Bullish Ahead Of Pending Acquisition

Shares of Altus Power Inc. (AMPS) edged lower by 0.20% on Monday after the company’s fourth-quarter earnings missed Wall Street expectations.

Altus reported a loss of $0.38 per share in Q4, significantly higher than an expected loss of $0.05. The company posted a loss of $0.17 per share during the same period a year earlier.

As for its topline, Altus reported revenue of $44.47 million, missing an estimate of $46.23 million. On a year-on-year basis, however, its revenue rose 30% from $34.19 million.

“In a year of economic uncertainty and evolving market conditions, Altus Power retained its market leadership position in commercial solar and surpassed 1 GW of operating assets,” said Gregg Felton, CEO of Altus Power.

The company said it is inching closer to its pending acquisition by TPG – the investment firm proposed to acquire Altus in an all-cash deal, offering $5 per share. Upon closure, Altus Power’s stock will be unlisted from the New York Stock Exchange and the company will go private.

In light of this, the company said it will not provide a financial outlook for fiscal 2025.

Altus announced two power projects this month, one each in North California and Colorado, of 1.7-megawatt and 1.4-megawatt capacities, respectively.

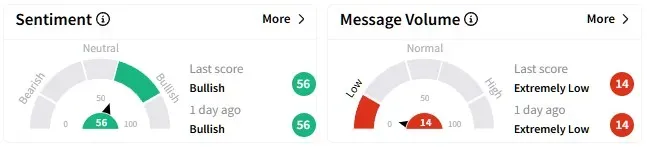

Retail sentiment on Stocktwits remained in the ‘bullish’ (56/100) territory at the time of writing.

Data from Koyfin shows the average price target for Altus Power is $5.08, marginally above Friday’s closing price. Two brokerages have ‘Buy’ or ‘Strong Buy’ calls, while five recommend ‘Hold.’

Altus Power’s stock has gained nearly 22% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: Arista Networks Stock Downgraded On Margin Pressures, But Shares Rise — Retail Sentiment Turns Sour

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)