Advertisement|Remove ads.

Amazon Q3 Earnings Preview: Analysts Expect Sluggish Profit Growth, AWS Performance In Focus

Amazon.com, Inc. is expected to report steady revenue growth in the third quarter, but profit growth would fall to single digits, according to analysts. That said, all eyes would be on the performance of the company's cloud unit, Amazon Web Services, which would determine the stock's course.

Notably, the unit’s 17.5% revenue growth in the second quarter — slightly ahead of market expectations — nevertheless triggered a selloff in Amazon’s stock. Investors often benchmark AWS against rivals Microsoft Azure and Google Cloud, and despite its scale, AWS’s growth continues to lag behind both.

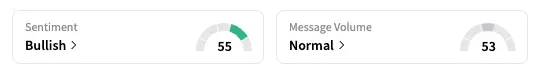

Amazon is set to report quarterly results after the market closes on Thursday, with investors appearing optimistic ahead of the release. The AMZN stock has risen for four straight sessions, taking it 7.6% higher from a recent low on Oct. 17. On Stocktwits, the retail sentiment remained ‘bullish’ over the last two days, up from ‘neutral’ previously.

Analysts expect Amazon’s revenue to rise nearly 12% to $177.16 billion in the last quarter, while adjusted EPS is seen rising 9.5% to $1.57, according to Koyfin. That would be the slowest profit growth rate in at least two years.

Analysts at UBS expect that the e-commerce company could see faster gross merchandise value growth and market share gains as it expands "one- and same-day Prime delivery," while AWS growth is expected to accelerate as "capacity constraints" and other headwinds ease.

Amazon will also face questions about two significant recent events: a massive AWS outage last week and its Tuesday announcement of plans to lay off 14,000 workers.

Although Amazon has mostly remained steady through a volatile year – marked by high U.S. inflation, geopolitical tensions, and most importantly, volatility from U.S. tariffs – the stock’s underperformance has caused frustrations. It has risen only 4.5% year-to-date, the least among the Magnificent Seven.

Currently, 67 of the 69 analysts covering the AMZN have a ‘Buy’ or higher rating on the stock, while two rate it ‘Hold,’ according to Koyfin. Their average price target of $267.92 implies a 17% upside to the stock’s last close.

Alphabet and Microsoft are reporting their quarterly results after the market hours on Wednesday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Booking Stock Rises Premarket As Results, Forecast Raise Boost Travel Outlook

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)