Advertisement|Remove ads.

ANI Pharma Reports Upbeat Q1 Earnings, Revises Full-Year Outlook: Retail’s Pleased

Shares of ANI Pharmaceuticals, Inc. (ANIP) were in the spotlight on Friday after the company reported upbeat earnings and revised its full-year guidance upward.

The company reported total net revenue of $197.1 million in the quarter, marking a growth of 43.4% year-on-year, and above an analyst estimate of $180.69 million, as per Finchat data.

The company’s rare diseases drug segment saw its net revenue increase 87%, which includes the Controphin gel used to treat rheumatoid arthritis flares and symptomatic sarcoidosis, along with corticosteroids Iluvien and Yutiq used to treat certain eye diseases.

Generic and other segment revenue rose by 38%.

The company’s adjusted earnings per share (EPS) came in at $1.70, up from $1.21 in the corresponding period of 2024, and above an expected $1.38.

The company now expects net revenue of $768 million to $793 million for the full year 2025, up from its previous guidance of $756 million to $776 million. The rare disease segment net revenue is expected to represent 47% to 48% of total company net revenues in 2025, the company added.

ANI Pharmaceuticals also raised its full-year adjusted EPS forecast to $6.27 to $6.62 from its previous outlook of $6.12 to $6.49.

ANI CEO Nikhil Lalwani noted that the Cortrophin gel delivered a record number of prescriptions and new patients in the first quarter.

“While our core franchises outperformed, demand for our retina assets, Iluvien and Yutiq, was impacted by Medicare-related market access challenges, turnover in our ophthalmology sales team, and seasonality,” he said, adding that demand for the “retina franchise” has accelerated in the second quarter.

The CEO also dismissed the impact of the Trump tariffs, noting that the company produces a major portion of its goods in the U.S.

“While we await more visibility on potential pharmaceutical industry-specific tariffs, we believe we are well positioned based on our strong U.S. footprint with over 90% of our revenues coming from finished goods manufactured in the U.S. and less than 5% of our revenues with direct reliance on China,” he said

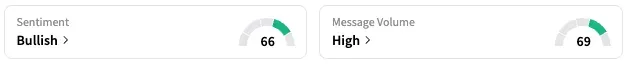

On Stocktwits, retail sentiment around ANI Pharmaceuticals rose from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume jumped from ‘normal’ to ‘high’ levels.

ANIP stock is up by over 21% this year and nearly 2% over the past 12 months.

Also See: Corvus Gets Price Target Hike From Oppenheimer On Positive Drug Trial Results: Retail’s Pleased

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraft_heinz_jpg_4db2a61952.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tom_lee_OG_2_jpg_9ae5c049c3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364715_jpg_59427544e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)