Advertisement|Remove ads.

Apple Stock In Focus After KeyBanc Downgrade: Retail Sentiment Unfazed

Apple Inc’s ($AAPL) stock was trading marginally in the green on Friday morning despite KeyBanc downgrading the stock to ‘Underweight’ from ‘Sector Weight’ with a price target of $200.

KeyBanc is one of three brokerages to have an underperform-equivalent rating on the stock, according to Stocktwits data.

According to its survey, even though a bulk of Apple’s customers are interested in upgrading to iPhone 16, they are concurrently interested in the iPhone SE as well.

“We think this shows the iPhone SE is not incremental, and could possibly be cannibalistic to iPhone 16 sales,” the brokerage said in its research note. This implies that the new iPhone SE might not add to Apple’s revenue, but rather take away from it since it would compromise the sales of the more expensive iPhone models.

KeyBanc also flagged lower-than-expected smartphone upgrade rates at Verizon Communications ($VZ), AT&T Inc. ($T), and T-Mobile US ($TMUS), all of which reported their quarterly results earlier this week.

The brokerage did note that the iPhone 16 was only available for two weeks during the third quarter, which may account for the lackluster sales figures. Additionally, it said that Apple Intelligence was not fully prepared when the phone launched.

However, “Given Apple Intelligence is initially rolling out in English and only in the U.S., other markets are likely to be even further behind the U.S.,” it said.

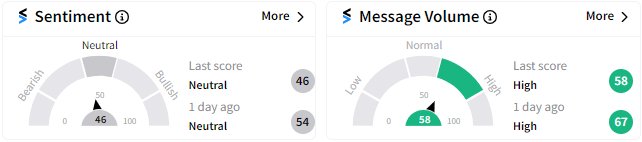

Retail sentiment on Stocktwits remains neutral (46/100) with Apple expected to report its earnings on Oct. 31, when it is expected to provide investors with a clearer picture of its future plans.

KeyBanc also cautioned that projections for sales across other product categories, including Mac, iPad, and Wearables, may be overly optimistic. The brokerage's historical analysis reveals that Apple has only experienced simultaneous growth in all product categories once in the past decade and twice in the last twenty years.

KeyBanc views Apple shares as "expensive by any measure," noting that the stock is trading at a 5x premium to the Nasdaq, compared to a three-year average of 3x.

The downgrade follows concerns raised by TF International Securities analyst Ming-Chi Kuo, who indicated that data suggests iPhone production is likely to fall short of expectations for the next three quarters, leading to year-on-year declines across the board.

The stock has rallied 24% so far in 2024.

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2203138957_jpg_dd735f9905.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195701587_jpg_dde6526b92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_core_scientific_coreweave_OG_jpg_58f1ea2dbf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ryanair_michael_oleary_jpg_d2a378f59e.webp)