Advertisement|Remove ads.

Birkenstock Scores 'Buy' Rating From Goldman Sachs, Shares Rise

Birkenstock Holding (BIRK) shares rose over 1.5% in Thursday's session and another 2% in extended trading, after Goldman Sachs raised its rating on the sandal maker.

The research firm raised the rating on the company's shares to 'Buy' from 'Neutral,' while maintaining its $60 price target, according to a summary of the investor note on The Fly. That indicates an over 15% upside to BIRK's last closing price.

Currently, 20 of the 22 analysts covering the stock have a 'Buy' or higher rating, and two rate it 'Hold,' according to Koyfin data. Their average price target is $72.26.

Goldman Sachs sees "robust" momentum and an attractive valuation for Birkenstock in a challenging macro backdrop. The company has a "strong" product proposition, with pricing power and opportunities to win share in a "highly fragmented" footwear market, the research firm said.

Goldman Sachs also noted Birkenstock's vertically integrated manufacturing setup in Europe, which would support the company's margins.

Although BIRK shares have rebounded over the last couple of weeks, they remain 15.5% below their 2025 peak achieved on Jan. 30.

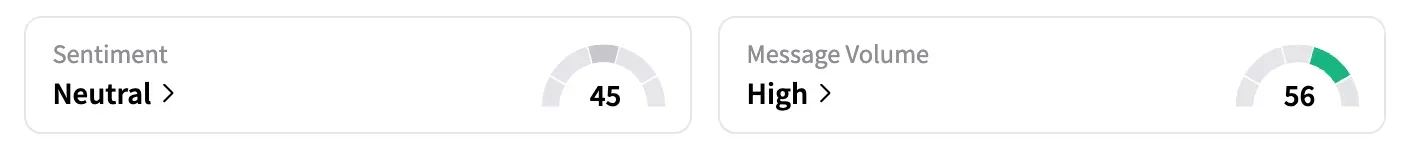

On Stocktwits, retail sentiment shifted to 'neutral' early Friday from 'bearish' the previous day, with several users taking note of the latest upgrade.

In May, Birkenstock raised its annual profit outlook and authorized a $200 million share buyback.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)