Advertisement|Remove ads.

Chinese E-Commerce Giant JD.com Could Reportedly Snap Up MediaMarkt Parent For $2.6B: Retail Bulls Eye Breakout

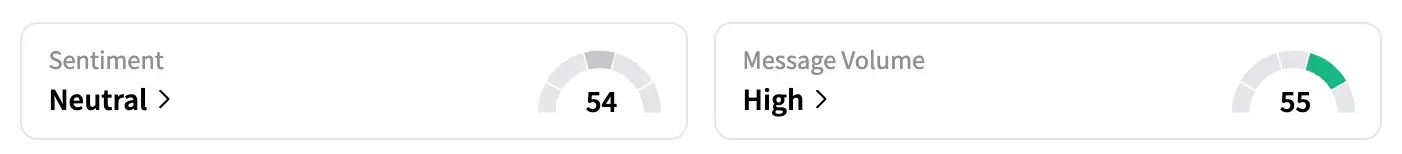

Retail sentiment for JD.com tracked lower but remained 'bullish' late Thursday, following a report that the Chinese tech giant was in advanced talks to acquire German electronics retailer Ceconomy.

The retailer, which owns electronics chains MediaMarkt and Saturn, confirmed the advanced talks but said that no legally binding agreements had yet been signed, according to a Reuters report.

A potential deal would value the business at around 2.2 billion euros ($2.59 billion), according to the report.

Ceconomy is listed on the Frankfurt Stock Exchange and owns electronics chains MediaMarkt and Saturn.

Those assets would give JD access to one of the largest online shops for electronic goods in Europe, as well as a network of around 1,000 stores across several European countries. Around 50,000 people work at the two chains.

JD considered an acquisition of British electronics retailer Currys last year, but there has been no update on the talks since then.

JD's U.S.-listed shares are down 24% from their 2025 high on Mar. 18 as analysts have grown concerned about the company's heavy investment in its food-delivery business in China. JD entered the space with JD Takeaway in February, sparking a discount war with market leaders Meituan and Alibaba's (BABA) Ele.me.

However, shares have rebounded of late, rising nearly 6% in the last six sessions.

On Stocktwits, the retail sentiment dropped a few notches in the 'Bullish' zone. A user pointed to a breakout on the stock's technical chart, signaling potential upside.

The potential acquisition news comes a month after JD founder Richard Liu vowed to accelerate the company's international expansion and double down on new areas, such as food delivery and travel booking.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)