Advertisement|Remove ads.

Bitcoin Nears $100K For The First Time Since February After Trump Reveals Trade Deal With UK

Bitcoin’s (BTC) price approached $100,000 in U.S. pre-market trading hours on Thursday, lifted by President Donald Trump’s announcement that a trade deal has been struck with the U.K.

The cryptocurrency rose more than 4% in the past 24 hours to trade around $99,700, according to CoinGecko. That marks its highest level since Feb. 4, bringing it within 1% of crossing six figures for the first time in three months.

Sui (SUI) registered the most gains among the leading cryptocurrencies, surging by over 11% in the last 24 hours.

Ethereum (ETH) was also among the top gainers, with a jump of 6.7% in the last 24 hours, but still trading under the $2,000 mark.

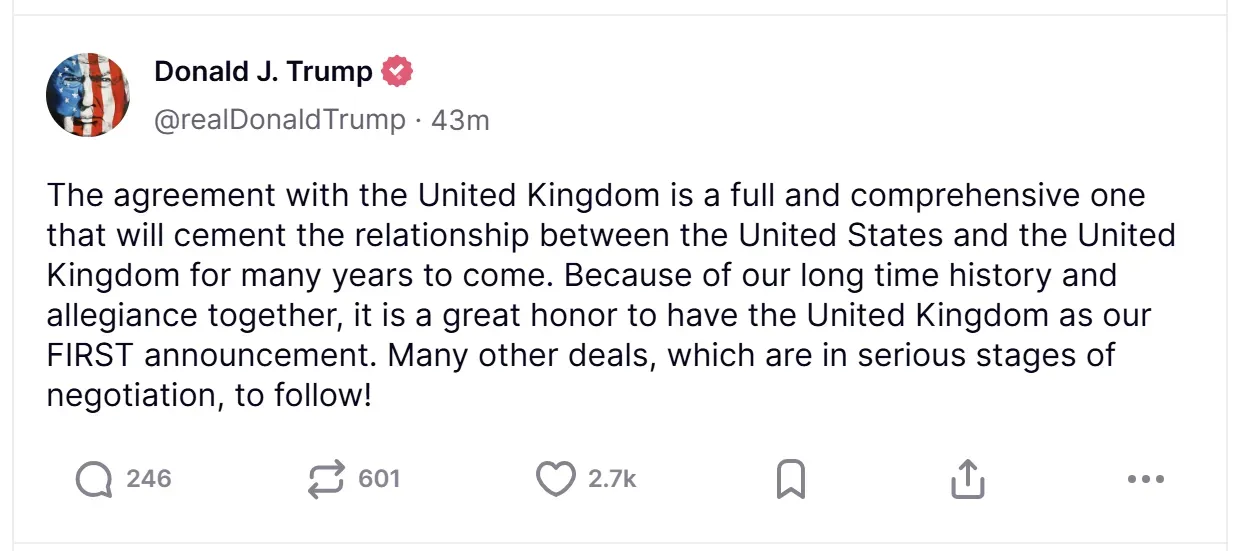

President Trump said the agreement with the U.K. would be “full and comprehensive,” and is expected to announce the deal at 10 a.m. ET. He added that multiple other deals are in “serious stages of negotiation.”

The surge in Bitcoin’s price came amid strong spot demand, accelerating inflows into Bitcoin exchange-traded funds (ETF) amid the macroeconomic uncertainty.

While the Fed held rates steady on Wednesday, in line with expectations, Fed Chair Jerome Powell’s remarks left markets debating the timing of future cuts. The CME FedWatch Tool shows a 55% probability of a July cut to the 4.00%-4.25% range.

ETF inflows have added fuel to Bitcoin's rally, with U.S.-listed funds drawing $3.4 billion over the past week.

More than $350 million in crypto liquidations occurred in the past 24 hours, per Coinglass data, with Bitcoin accounting for about a third of the total. Roughly $116 million of those were short positions on BTC.

According to Barchart data, resistance lies between $98,250 and $98,800. If Bitcoin breaks above $100,000 — a key technical and psychological level — it could target $104,000, with room to retest its all-time high near $109,000, last seen in January.

Crypto stocks rallied in tandem with Bitcoin’s surge. Riot Platforms (RIOT), TeraWulf (WULF), and Marathon Digital (MARA) rose more than 5% in premarket trading, while Strategy (MSTR), backed by Michael Saylor, was up 4.8%.

Bitcoin’s price is now up 6% in 2025 and nearly 60% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Trump Announces ‘Comprehensive’ Trade Deal With UK, Dow Futures Surge

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)