Advertisement|Remove ads.

Blackstone Beats Q3 Estimates, AUM Reaches Record $1.11T: Stock Rises, But Retail Caution Lingers

The world’s largest alternative investment firm Blackstone Inc (BX) on Thursday reported better-than-expected third-quarter (Q3) results, driven by significant fund appreciation and a broad-based acceleration across its businesses.

Blackstone reported a 44% rise in Q3 revenue to $3.66 billion, higher than a Wall Street estimate of $2.68 billion. Earnings per share (EPS) came in at $1.01, topping an estimate of $0.98.

The firm’s assets under management (AUM) rose 10% year-over-year (YoY) to a record of $1.11 trillion, supported by $40.5 billion of inflows in the quarter.

CEO Stephen A. Schwarzman said Blackstone invested or committed $54 billion in the quarter — the highest in over two years — and deployed $123 billion in the last twelve months since the cost of capital peaked.

“The third quarter also represented the highest amount of overall fund appreciation in three years, and our limited partners entrusted us with over $40 billion of inflows,” he said in a statement.

During the quarter, the firm’s corporate private equity funds appreciated 6.2% while infrastructure and tactical opportunities funds rose 5.5% and 4.3%.

Private equity AUM increased 12% to $344.7 billion with inflows of $10.2 billion in the quarter while realizations stood at $5.3 billion. Credit and Insurance AUM rose 22% to $354.7 billion with inflows of $21.4 billion while realization stood at $9.6 billion.

The firm’s distributable earnings rose to $1.278 billion compared to $1.211 billion in the same period a year ago.

Blackstone declared a quarterly dividend of $0.86 per share to record holders of common stock at the close of business on Oct. 28, 2024. The dividend will be paid on Nov. 4, 2024.

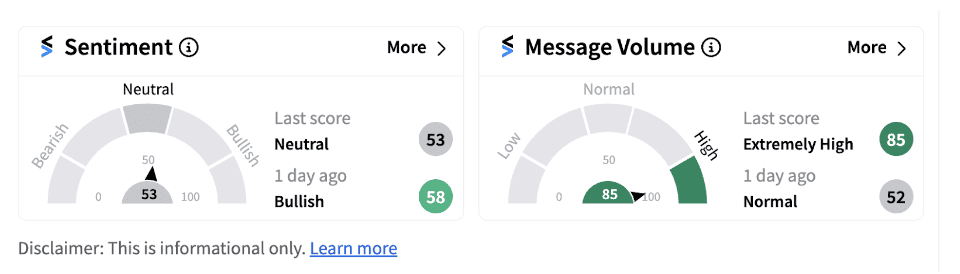

Following the announcement, shares of Blackstone were trending over 3% higher in Thursday’s pre-market session. However, retail sentiment dipped into the ‘neutral’ territory (53/100) from ‘bullish’ a day ago.

Also See: Cleveland Fed Says Rent Inflation May Not Return To Pre-Pandemic Norm Until Mid-2026

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1242030871_jpg_12741b089b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)