Advertisement|Remove ads.

California Resources Stock Dips After Q4 Earnings Disappoint Investors — Retail Sentiment Improves But Stays Bearish

Shares of California Resources Corp (CRC) fell over 3% on Monday after the company’s fourth-quarter earnings and revenue failed to meet Wall Street expectations.

The company reported adjusted earnings per share (EPS) of $0.91 compared to a Street estimate of $0.97. Net income for the quarter stood at $33 million versus $345 million in the previous quarter.

Revenue came in at $877 million compared to an analyst estimate of $901.36 million.

Net oil production per day stood at 112 million barrels per day (MBbl/d) compared to 113 MBbl/d in the third quarter.

CEO Francisco Leon said that in 2025, the company will focus on delivering value through its integrated asset portfolio, which combines conventional oil and gas, carbon management, and an expanding power solutions business.

“We will maintain financial strength to generate sustainable cash flow while returning significant capital through dividends and opportunistic share buybacks to our shareholders,” he said.

For 2025, the company estimates capital investments to range between $285 and $335 million, including drilling, completions, and workover capital of $165 - $180 million and carbon management capital of $20 - $30 million.

CRC ended the year with $354 million in available cash and cash equivalents, $983 million in available borrowing capacity under its facility, and $1.337 billion in liquidity.

Following the earnings release, CRC stock fell nearly 4% in Monday’s pre-market session.

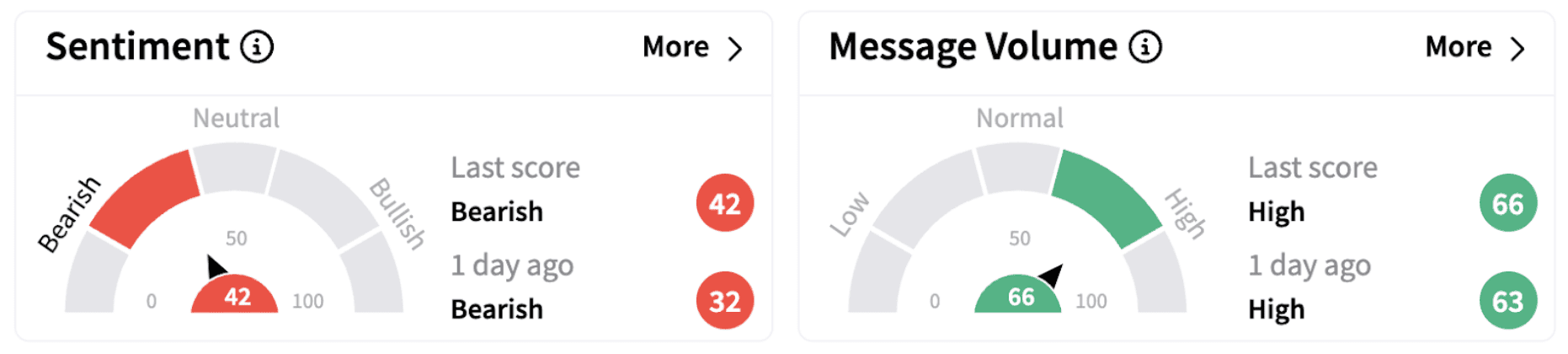

On Stocktwits, retail sentiment improved from the day before but continued to trend in the ‘bearish’ territory (42/100). The move was accompanied by ‘high’ retail chatter.

CRC stock has lost over 17% in 2025 and is down 19% over the past year.

Also See: FedEx Gets A Price Target Cut From JPMorgan Ahead Of Q3 Earnings: Retail Remains Skeptical

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)