Advertisement|Remove ads.

Chinese Auto Stocks Are Crushing US Rivals As 2025 Hits The Halfway Mark

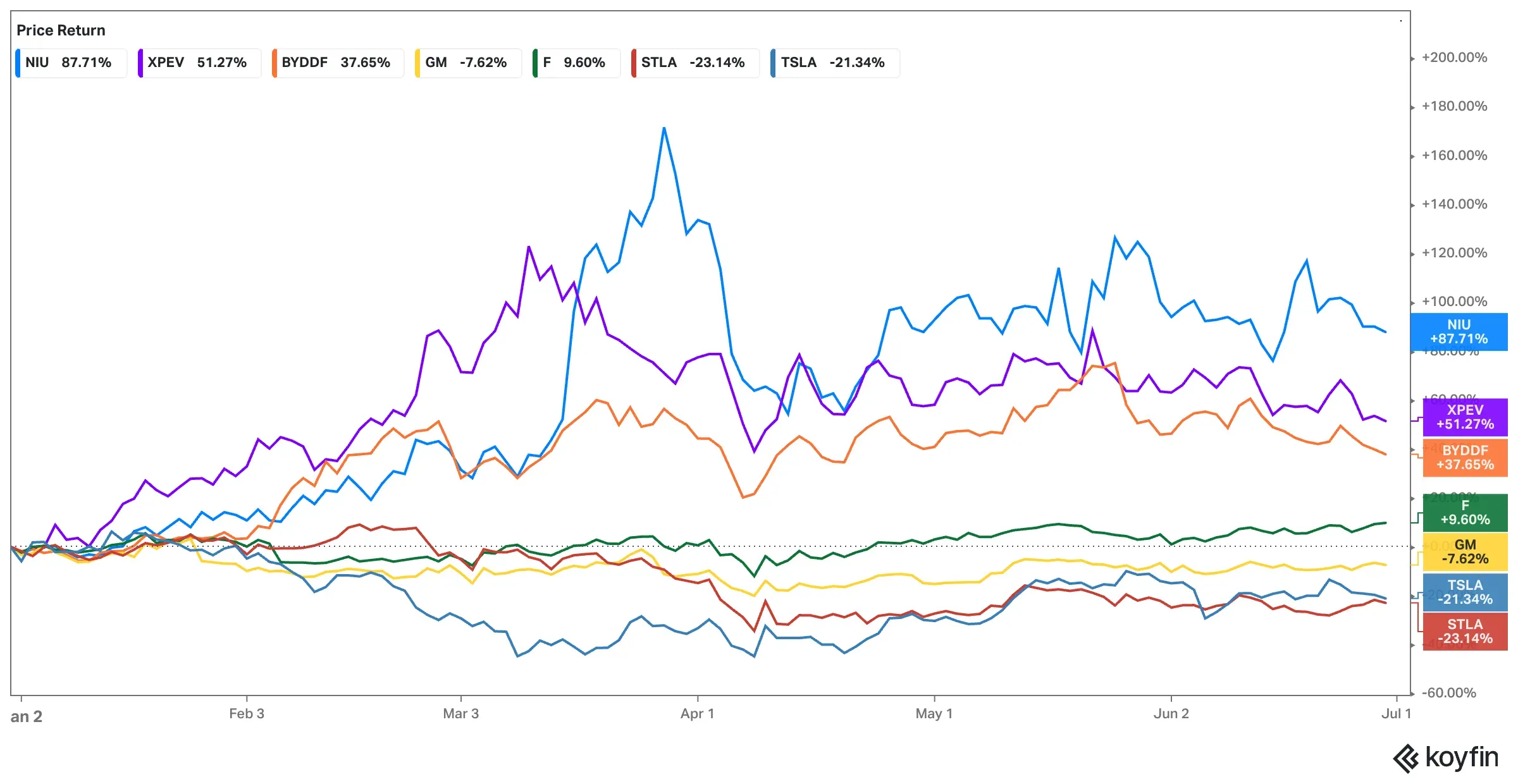

Halfway through 2025, the scoreboard for auto stocks listed in the U.S. is clear: Chinese players are dominating, and American automakers are scrambling to catch up.

The backdrop? A chaotic first half, punctuated by Donald Trump's return to the White House and a sweeping tariff blitz in April. U.S. automakers are still reeling from a 25% tariff on imported vehicles. While components received some leniency, and auto duties won't stack on top of steel and aluminum tariffs, it has done little to soothe investor nerves.

Even with Trump offering lead time for domestic companies to reconfigure their supply chains, the top-performing auto stocks in the U.S. market this year include three Chinese names, despite Chinese EVs remaining effectively banned from the U.S. due to tariffs and national security concerns.

Leading the pack:

- Niu Technologies (NIU): The electric scooter and e-bike firm is up a staggering 87% in 2025. However, retail traders on Stocktwits have become cautious, with sentiment shifting from 'bullish' to 'bearish' over the past six months.

- Xpeng (XPEV): Shares of the Guangzhou-based EV maker have jumped more than 51% this year. XPeng has delivered 162,578 EVs in the first five months alone — a 293% year-over-year surge. Analysts at Goldman Sachs and Morgan Stanley are bullish, citing improved margins and strong AI integration. Stocktwits sentiment has turned 'neutral' from 'bearish' earlier in the year.

- BYD (BYDDF, BYDDY): Dubbed the "Tesla killer," BYD shares are up over 37% YTD. Sales are climbing in both China and Europe, and the company recently revealed tech that claims to charge an EV in under five minutes. Still, industry associations and analysts warn that its ongoing price war could fuel "vicious competition" in China. Retail traders remain ‘bearish’ on the stock as they did six months ago.

Also in the green:

- Ferrari (RACE): The luxury automaker ranks fourth, with a 16.4% rise YTD, powered by strong earnings and resilient demand for customization. Even with Trump's 25% tariffs on foreign autos, Ferrari's well-heeled customer base remains unfazed. Analysts even view it as a "safe haven" amid macro uncertainty.

- Ford (F): The lone Detroit "Big Three" survivor in positive territory, Ford is up nearly 10% YTD. Its relatively minimal exposure to import tariffs and improving monthly U.S. sales (including EVs) have helped it stay ahead of the pack among American automakers.

In the red:

- General Motors (GM): Down 7% YTD, despite major U.S. investment plans.

- Stellantis (STLA): Off over 20% with a leadership shakeup, production woes, and tariff exposure dragging it down.

- Tesla (TSLA): Down 21%, even as it pushes hard on robotaxis and AI.

- Lucid (LCID): Down 30%.

- Rivian (RIVN): Barely hanging on in positive territory, up just over 3%.

For U.S. auto stocks, the second half of 2025 may hinge on whether they can outmaneuver trade headwinds and stop Chinese competitors from lapping them again.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)