Advertisement|Remove ads.

Citi Stock Gains After Agreeing To Sell Stake In Banamex Unit For $2.3B To Mexican Tycoon

Citigroup (C) stock gained 0.7% in extended trading on Wednesday after the bank agreed to sell a 25% stake in its Mexican retail banking unit, Banamex, for 42 billion pesos ($2.3 billion) to local businessman Fernando Chico Pardo.

After the deal closes, expected in the second half of 2026, Chico Pardo will become the chairperson of Banamex. The Mexican billionaire will be acquiring 520 million shares of the banking group, ahead of its planned listing.

“This investment from Fernando Chico Pardo, one of the most respected business leaders in Mexico, is a resounding endorsement of Banamex’s strength and potential,” said Citi CEO Jane Fraser.

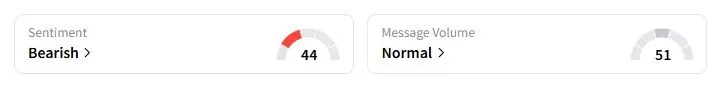

Retail sentiment on Stocktwits about Citigroup was in the ‘bearish’ territory at the time of writing.

Citi had first launched a sale of Banamex in 2022 as part of its strategy to simplify its business and exit the retail banking business in several international markets. However, the bank had to abandon its efforts after the former Mexican President, Andrés Manuel López Obrador, imposed restrictions on deal terms, which included the requirement that the buyer be Mexican and would not carry out mass layoffs.

According to a Bloomberg News report, citing people familiar with the matter, CEO Jane Fraser met with President Claudia Sheinbaum last month to seek her approval for Chico Pardo’s. Like her predecessor, Sheinbaum also didn’t want a foreign buyer or further consolidation in Mexico’s highly concentrated banking sector, the report added. Her administration also welcomed the Chico Pardo bid.

The deal was negotiated by Chico Pardo himself, the report added. Citigroup incurred a goodwill impairment charge of approximately $726 million, which the New York-based bank recorded in the third quarter and stated is capital-neutral to the bank.

Citi added that the divestiture of Banamex remains a strategic priority, and any decisions related to the timing and structure of the proposed initial public offering will be made in accordance with market conditions and regulatory approvals. Earlier, Fraser had noted that Banamex, one of the largest Mexican financial institutions, was growing at a faster pace than its peers.

Earlier on Wednesday, Truist lifted the price target on Citi to $112 from $105 and maintained a ‘Buy’ rating, according to TheFly. The brokerage raised its revenue estimates for U.S. banks due to an improved capital markets environment, though higher compensation expenses partially offset the gains.

Citi’s stock has gained over 43% this year, outpacing the 11.2% gains of the S&P 500 Financials sector, as it aggressively trimmed costs and improved its balance sheet.

Also See: Oklo Stock Logs Worst Day In Over 2 Months — But Goldman Sachs Sees Support For Elevated Valuation

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_golden_dome_resized_jpg_38d699de1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222922178_jpg_42dd8f319f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)