Advertisement|Remove ads.

Ford Says Upcoming EV Battery Plant In Michigan Will Qualify For Production Tax Credits: Report

Ford Motor Co (F) reportedly said on Tuesday that it believes its planned Michigan electric vehicle battery plant will qualify for production tax credits under the U.S. Inflation Reduction Act.

The company stated that the $3 billion plant, currently under construction, is expected to employ 1,700 workers and is “on track” to qualify for the production tax credit, Reuters reported.

Shares of the automaker are trading nearly 1% higher at the time of writing.

The factory in Marshall is now 60% complete. It was announced in February 2023 and is expected to begin producing batteries in 2026 using technology from Chinese battery maker CATL to power the company’s future electric vehicles. Ford’s new plant will be run by BlueOval Battery Michigan, a wholly owned Ford subsidiary.

Reuters noted that the tax bill passed by the U.S. House of Representatives would have barred tax credits for batteries produced with components from some Chinese companies or under a license agreement with Chinese companies.

However, the final tax and budget bill revised the rules. The Alliance for Automobile Manufacturers, a group representing General Motors, Ford, and Toyota, among others, praised the final bill for revising language on a battery production tax credit that "preserved auto-related advanced manufacturing across the country and prohibited Chinese companies from eligibility," the report added.

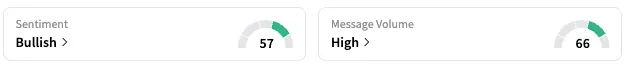

On Stocktwits, retail sentiment around Ford has been trending in the ‘bullish’ territory over the past 24 hours, coupled with ‘high’ message volume.

Ford’s stock is up by 18% this year but down by about 10% over the past 12 months.

Read Next: Novo Nordisk Seeks Approval For Higher Wegovy Dose In Europe

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_opendoor_OG_jpg_55300f4def.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_snap_resized_jpg_9672f61595.webp)