Advertisement|Remove ads.

Foremost Clean Energy Stock Slumps After Blistering Rally, But Retail Still Eyes Buying The Dip

Foremost Clean Energy (FMST) shares dropped 15.3% on Monday, marking their worst session since Jan. 27, 2025.

Investors booked profits after the stock gained 291.7% in one month. The stock ended higher in 10 of the past 13 trading sessions.

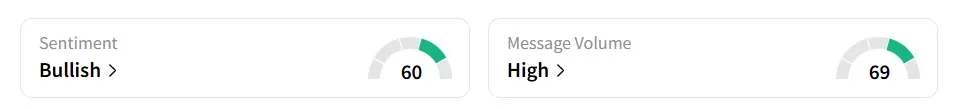

Retail sentiment toward Foremost Clean Energy stock among Stocktwits users turned ‘bullish’ from ‘neutral’ last week, amid ‘high’ message volumes.

One user expects the stock to reverse losses and gain over the next two sessions.

However, one user was apprehensive about the company’s prospects given the possibility of a deal for rare earth minerals between the U.S. and China.

The two countries are set to continue trade talks in London on Tuesday. They will focus on resolving disputes over export controls on critical goods such as rare earth minerals, which are essential for industries like automotive and energy.

Last week, Foremost Clean Energy received a three-year exploration permit from the Saskatchewan Ministry of Environment for its Murphy Lake South Property, an area known for multiple occurrences of high-grade uranium mineralization.

The permit, which runs until Dec. 31, 2027, authorizes the company to conduct exploration work, including geochemical studies, geophysical surveys, and drilling up to 30 holes.

Year-to-date, Foremost Clean Energy shares have risen over 200%.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1813801150_jpg_9e452258fa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)