Advertisement|Remove ads.

Fox Stock Jumps After Political Ad Spending, Live Sports Coverage Boost Q2 Results: Retail Turns Upbeat

Fox Corp. (FOXA) stock rose Tuesday afternoon after the New York-based news, sports and entertainment company announced better-than-expected fiscal year 2025 second-quarter results.

The company reported second-quarter adjusted earnings per share (EPS) of $0.96, sharply higher than the $0.34 earned a year ago, and the $0.64 consensus estimate, according to Yahoo Finance.

Revenue rose 20% year over year (YoY) to $5.08 billion versus the $4.82 billion average analysts’ estimate. Advertising revenue climbed 21% to $2.42 billion, thanks to higher political advertising revenues, higher MLB post-season ratings and NFL pricing, continued digital growth led by the Tubi AVOD service, and stronger news ratings and pricing.

Fox said its affiliate revenue rose a more modest 6% due to 9% growth in the Television segment and 4% in cable network programming.

Business segment-wise break-up showed cable network revenue rising about 31% to $2.17 billion and television revenue increasing 16.5% to $2.96 billion.

Quarterly adjusted earnings before interest, taxes, depreciation and amortization jumped 123% to $431 million.

Fox Chair and CEO Lachlan Murdoch said, “A compelling fall sports schedule combined with a record-breaking presidential election news cycle resulted in second-quarter results that reflect the strength and breadth of FOX.”

“Whether measured in terms of engagement, monetization or profitability, our focused strategy of live news and sports programming, coupled with our growing digital initiatives, continues to deliver.”

Fox declared a dividend of $0.27 per Class A and Class B share, payable on March 26 to shareholders of record as of March 5. The stock has gained about 7% this year, following a 66% jump in 2024.

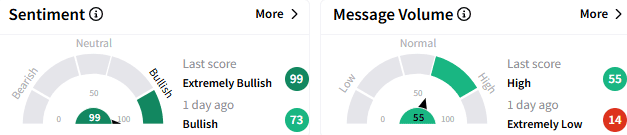

On Stocktwits, retail sentiment toward Fox stock improved to ‘extremely bullish’ (99/100), matching the level seen in late April, from ‘bullish’ a day ago. Message volume spurted to ‘high’ levels.

Fox stock climbed 4.90% to $54.49 at the last check, trading off the day’s high of $55.56.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trump_media_and_technology_group_media_009b60f8cd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_HP_corporate_logo_resized_a2479d3136.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_terawulf_OG_jpg_a87a18705d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)