Advertisement|Remove ads.

How High Can IBRX Stock Go Now? Here’s What Wall Street Thinks After Saudi Nod For Bladder Cancer Filing

- D. Boral Capital reiterated a ‘Buy’ rating and a $24 price target, implying nearly 300% upside from the stock's last close.

- Saudi regulators encouraged a filing for a bladder cancer therapy and initiated discussions to expand Anktiva to additional tumor types.

- ImmunityBio's trial data showed improved survival across multiple cancer types.

Shares of ImmunityBio, Inc. (IBRX) climbed on Tuesday and extended their move after-hours on Tuesday as Saudi FDA discussions around bladder cancer treatment put fresh attention on the stock’s upside potential.

IBRX stock jumped 1.3% in Tuesday’s regular session and added another 0.6% in after-hours trading.

Analyst Sees Nearly 300% Upside For IBRX

D. Boral Capital on Tuesday maintained a ‘Buy’ rating on ImmunityBio and reiterated a $24 per share price target, implying an upside of nearly 300% to the stock's last close.

According to Koyfin estimates, ImmunityBio’s price target range is $7 to $24, with a 12-month average target of $11.8, representing about 96% upside from current levels.

The stock has delivered a 66.3% trailing one-year return. Analyst consensus on Koyfin remains ‘Strong Buy’, based on five covering analysts, including one ‘Buy’, four ‘Hold’, and no ‘Sell’ or ‘Strong Sell’ ratings. The company’s average analyst rating is 4.8 out of five.

Saudi FDA Backs Bladder Cancer Filing

ImmunityBio on Tuesday said the Saudi Food and Drug Authority (SFDA) encouraged the company to submit a regulatory package for its recombinant Bacillus Calmette-Guerin (BCG) therapy to expand access to bladder cancer treatment in the region.

BCG is an immunotherapy derived from weakened bacteria and is commonly used to treat early-stage, non-muscle-invasive bladder cancer by triggering an immune response within the bladder. ImmunityBio said its recombinant BCG, a lab-manufactured version that will provide a more reliable supply, is expected to be submitted to the SFDA within the coming weeks.

Saudi Regulators Weigh Anktiva Expansion

The company also said it initiated discussions with Saudi regulators to expand Anktiva, its immune-activating therapy, in combination with checkpoint inhibitors to additional tumor types.

Anktiva stimulates natural killer (NK) and T cells, which are immune cells that attack cancer cells. Saudi regulators granted accelerated approval last month for Anktiva, used with checkpoint inhibitors in patients with metastatic non-small cell lung cancer whose disease progressed after standard therapy. The therapy is also approved in Saudi Arabia for cases where traditional BCG treatment no longer works.

ImmunityBio said data from its Quilt-3.055 Phase 2b basket trial showed that adding Anktiva restored checkpoint inhibitor activity across multiple cancers, including lung, bladder, melanoma, renal, gastric, head and neck, and cervical cancers. Among patients with relapsed lung cancer, the company reported a median overall survival of 14.1 months.

ImmunityBio Pushes Back On FDA Standards

ImmunityBio’s executive chairman, Patrick Soon-Shiong, has publicly criticized the U.S. regulatory process for Anktiva.

In a recent interview, Soon-Shiong said U.S. regulators have required randomized trials across multiple tumor types for Anktiva, while allowing Merck’s Keytruda to expand across cancers based on single-arm studies. He said this has limited patient access to Anktiva outside a narrow bladder cancer indication.

ImmunityBio has said it plans to resubmit an FDA application seeking expanded approval for Anktiva in bladder cancer later this year.

How Did Stocktwits Users React?

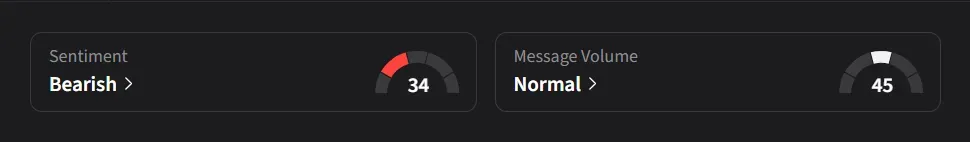

On Stocktwits, retail sentiment for IBRX was ‘bearish’ amid a 160% surge in 24-hour message volume.

One user expressed bullish sentiment toward the stock, saying, “NK cells are the key to everything, including COVID. People with bad immune system were at higher risk. We should be looking at NK cells most things health related!”

Another user said, “Ungodly amount of options expire on the 20th, we'll see a run to 8$ once those expire.”

IBRX stock has surged over 200% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rivian_automotive_jpg_e356c1abe5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)