Advertisement|Remove ads.

Humacyte Stock Continues Slide Despite Lower Than Expected Q4 Loss – But Retail Gets More Bullish

Shares of Humacyte Inc. (HUMA) tumbled nearly 11% on Friday despite the company reporting a narrower-than-expected loss.

The company, which has not generated revenue in the past two years, reported a net loss of $20.9 million for the fourth quarter, compared to $25.11 million for the corresponding quarter of 2023.

Net loss per share came in at $0.16, lower than the $0.24 loss in the corresponding period of 2023 and below the consensus estimate of $0.25, according to FinChat data.

Research and development expenses in the quarter were $20.7 million, slightly higher than the $20.2 million reported in the corresponding quarter of 2023.

Humacyte is a commercial-stage biotechnology platform developing universally implantable bioengineered human tissues.

The company received approval from the Food and Drug Administration (FDA) for Symvess, an acellular tissue-engineered vessel for the treatment of extremity vascular trauma, late last year, and commenced its commercial launch earlier this year

CEO Laura Niklason said that the commercial launch of Symvess is proceeding at full speed.

“So far the market has responded well, and 34 hospitals have already initiated the Value Analysis Committee (VAC) approval process,” Niklason said.

However, earlier this week, The New York Times published a report questioning the FDA’s approval for Symvess, alleging that the agency’s scientists flagged questionable study results and potential fatal ruptures of the product.

Humasys CEO, on Thursday, said in a statement that the company believes strongly in both the safety and effectiveness of their product.

“An independent safety review committee concluded that any instances of amputation or patient death were due to the underlying injuries and complications, and not due to Symvess,” she said.

HUMA shares have declined nearly 47% in the last five trading sessions.

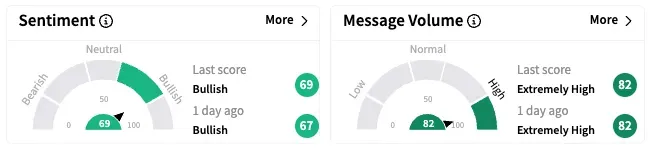

On Stocktwits, retail investor sentiment about Humacyte rose marginally within the ‘bullish’ territory (69/100), while message volume remained at the ‘extremely high’ levels over the past 24 hours.

On Stocktwits, a user expressed optimism on the stock.

Another user opined that the earnings call made them feel better about the stock, but the negative press is too much to get over immediately.

HUMA shares are down over 60% this year and over 40% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Wingstop_jpg_0737a8a046.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2239899916_jpg_cde8ab32f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_solaredge_technologies_resized_56b964ed87.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240244443_jpg_6b67e8f303.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Crowdstrike_logo_resized_cce5c5379f.jpg)